Advertisement|Remove ads.

SoFi’s ‘Disruptive’ Bank Model Gets A Wall Street Thumbs Up: Retail Chatter Explodes 380% In 24 Hours

SoFi Technologies Inc. (SOFI) received a bullish endorsement from William Blair on Tuesday, following its second-quarter (Q2) results, with the firm urging investors to add to their positions despite a notable stock surge.

SoFi Technologies stock traded over 16% higher on Tuesday morning.

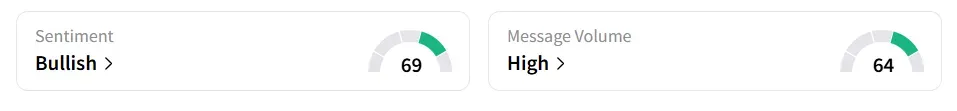

Retail sentiment around the stock jumped to ‘bullish’ (69/100) from ‘bearish’ (64/100) the previous day. Message volume shifted to ‘high’ from ‘low’ levels in 24 hours.

The stock saw a 382% surge in user message count over the last 24 hours.

Stocktwits users expressed optimism about the earnings.

In a note to clients, the brokerage said Wall Street has only begun to grasp the pace and scope of SoFi’s digital banking model, which it described as ‘disruptive,’ as per TheFly.

William Blair expects SoFi’s expanding lineup of financial products, ranging from savings and spending tools to lending, investing, and advisory services, to erode the market share of legacy banks rapidly.

William Blair maintained its ‘Outperform’ rating on SoFi, projecting a potential share price of around $30 by 2026. That target indicates more than 30% upside from the stock's current price.

The brokerage believes SoFi's tech-driven approach gives it a strong advantage as traditional banks struggle to modernize quickly enough to compete.

SoFi’s Q2 revenue jumped 43% year-on-year (YoY) to $854.9 million, beating the analysts' consensus estimate of $804.36 million, as per Fiscal AI data.

Adjusted earnings per share (EPS) of $0.08 also surpassed the consensus estimate of $0.06.

The company’s continued momentum in customer growth and expanding product offerings appears to have reinforced investor confidence.

SoFi Technologies stock has gained over 58% in 2025 and over 232% in the last 12 months.

Also See: This Server Giant Is Sprinting Into The AI Era: Here’s What’s Fueling Retail Interest

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137832_jpg_1de3e68131.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)