Advertisement|Remove ads.

Hims & Hers Stock Rebounds After-Hours After Novo Nordisk Split Triggers Record Plunge — Retail Traders Stay Loyal

Hims & Hers Health Inc. (HIMS) rebounded 4.38% in after-hours trading Monday, partially clawing back losses after the stock plunged over 34% during the regular session, its worst single-day drop on record.

The sharp selloff followed Novo Nordisk’s (NVO) decision to cancel its collaboration with Hims over the weight-loss drug Wegovy, citing concerns about “illegal mass compounding and deceptive marketing.”

Hims & Hers CEO Andrew Dudum pushed back forcefully on X, accusing Novo of misleading the public. “We refuse to be strong-armed by any pharmaceutical company's anticompetitive demands that infringe on the independent decision making of providers and limit patient choice,” he wrote, adding that Novo pressured Hims to steer patients toward Wegovy regardless of clinical fit.

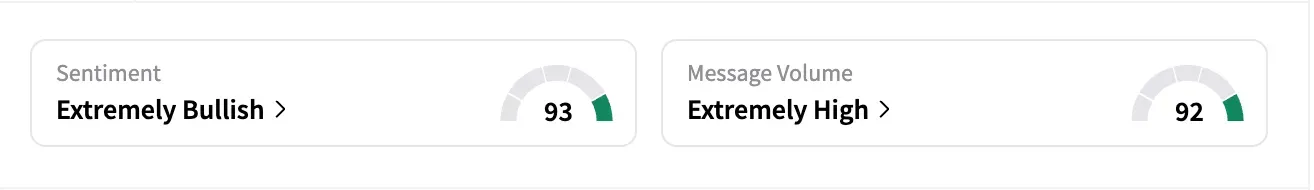

The dispute triggered a massive spike in retail discussion. On Stocktwits, 24-hour message volume around HIMS soared 6,717% — the fifth highest among healthcare stocks. It was the top trending ticker on the platform late Monday.

Sentiment flipped from ‘neutral’ to ‘extremely bullish’ by Monday evening, showing retail traders weren’t backing down despite short interest rising to 27.21% from 19.7% at the start of the year.

“This is extremely overblown as most people don't understand what happened here. Sales will take a very minor impact unless FDA rules are changed which would take years and need huge congressional oversight,” said one user.

“This is hilarious, impact of NVO situation on rev is zero as CEO just confirmed, they cant legally stop them selling wegovy as under contract,” wrote another user. “Selling way overdone!! See you at $55+ by end of the week!!”

Hims entered the red-hot GLP-1 weight-loss space last year, offering compounded semaglutide (the FDA allows this only during drug shortages).

Still, BofA analyst Allen Lutz flagged on Monday that Hims' year-over-year core revenue growth has slowed, from 45% in the third quarter of 2024 to 29% in the first quarter of 2025, and could fall to mid-teens in the second half of this year. He reiterated an 'Underperform' rating.

Despite Monday’s drama, HIMS stock remains up over 70% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)