Advertisement|Remove ads.

Hims & Hers Stock’s Retail Army Brushes Off Amazon Medical One’s Rival Service Even As Citi Sees Threat

Shares of Hims & Hers ($HIMS) plummeted nearly 15% on Thursday after Amazon.com, Inc. ($AMZN) launched its new Amazon One Medical Pay-per-visit telehealth service, which Citi analysts believe poses a significant threat to Hims’ core offerings.

The service targets cash-pay patients with competitive pricing, including men’s hair loss treatments starting at $16/month, anti-aging skincare for $10/month, and erectile dysfunction (ED) treatments for $19/month.

Amazon’s service offers pay-per-visit telehealth for over 30 conditions like pink eye, flu, and sinus infections. Prime members can access on-demand messaging visits for $29 and video visits for $49, with prescriptions filled easily through Amazon Pharmacy.

Citi noted that this is Amazon’s “next iteration” of its Amazon Clinic service, which originally launched in 2022, but with Amazon-affiliated doctors and more attractive pricing compared to Hims.

The analysts pointed out that while Hims includes the cost of provider visits in its subscription pricing, Amazon separates this cost, making its pricing more appealing, particularly for longer prescriptions and fewer annual consults.

Citi emphasized that Hims’ strategy to differentiate itself by personalizing treatment via compounding will be crucial in facing this competition.

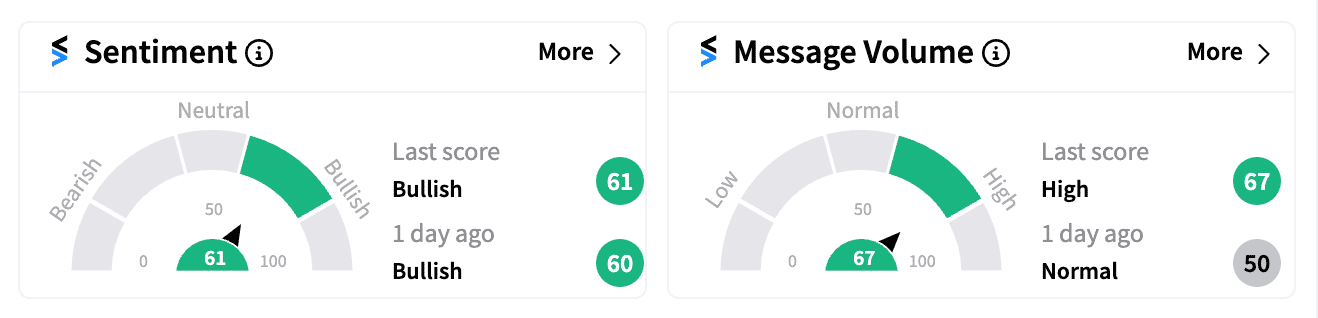

Hims & Hers was one of the top 20 trending tickers on Stocktwits on Thursday morning, with retail sentiment staying ‘bullish’.

One bullish user downplayed Amazon’s impact, highlighting that similar services from Amazon have existed for years without disrupting Hims’ business.

Others reiterated their faith in HIMS’ consistently upbeat earnings and organic growth from its offerings.

A Stocktwits poll also reveals that 46% of retail investors believe that Amazon's latest offering will have just a temporary effect and "no big impact" on HIMS, while 27% believe it presents a "major threat."

Meanwhile, Hims & Hers is proactively responding to a surge in demand for GLP-1 medications, like Novo Nordisk’s Wegovy, due to shortages. The company announced a new GLP-1 tracker, enabling patients to report shortages and locations where they can’t access the drugs.

Hims plans to aggregate and publish this data to prove to the FDA that shortages are still prevalent. CEO Andrew Dudum shared that over 80,000 people on their platform reported difficulties accessing these medicines, with over 2,000 new reports in a single day last week.

Hims & Hers has consistently beaten earnings-per-share (EPS) and revenue estimates for the past four quarters, with shares up more than 140% year-to-date, significantly outperforming major indices.

On Stocktwits, HIMS has gained significant retail attention over the past year: new followers have grown by 86% while message volume has soared by nearly 1000%.

For updates and corrections, email newsroom@stocktwits.com

Read next: Tapestry, Capri Stocks Split Paths After Scrapping Merger Deal: Retail Weighs Its Bets

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)