Advertisement|Remove ads.

Tapestry, Capri Stocks Split Paths After Scrapping Merger Deal: Retail Weighs Its Bets

Shares of Tapestry Inc. ($TPR) surged 11% on Thursday morning, while Capri Holdings Inc. ($CPRI) saw its stock drop roughly 4% after both companies announced the termination of their planned merger.

The luxury fashion giants mutually agreed to cancel the deal, citing uncertainty in the legal process that was unlikely to be resolved before the Feb. 10, 2025 deadline.

Tapestry, known for brands like Coach, Kate Spade, and Stuart Weitzman, and Capri, the parent company of Michael Kors, Versace, and Jimmy Choo, originally announced their merger in August 2023.

However, the deal faced significant regulatory hurdles, with the Federal Trade Commission (FTC) suing to block the merger in April this year.

The FTC had argued that combining the two companies would reduce competition in the “accessible luxury” handbag market, leading to higher prices and less competition for workers.

A federal judge ruled against the merger late last month, effectively halting the acquisition, although both stocks saw a brief rally following the 2024 U.S. presidential election on hopes that the incoming Trump administration would be friendlier to dealmaking.

“With the termination of the merger agreement, we are now focusing on the future of Capri and our three iconic luxury houses. Looking ahead, I remain confident in Capri’s long-term growth potential for numerous reasons,” said Capri CEO John Idol.

Meanwhile, Tapestry announced an additional $2 billion share repurchase program, including plans to partially execute it through an Accelerated Share Repurchase (ASR) program.

Tapestry also reaffirmed its commitment to maintaining its annual dividend rate of $1.40 per share and aims to increase dividends in line with earnings growth.

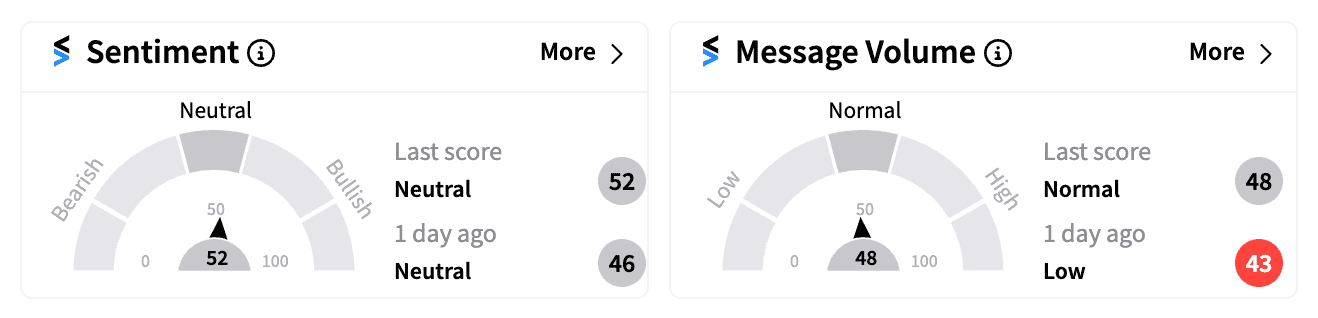

Retail sentiment on Stocktwits for both TPR and CPRI stocks was neutral on Thursday morning, despite increased message volume.

One user commented on Tapestry’s stream, “Congrats to those who had 5 cents calls in Tapestry, Capri pain is Tapestry’s gain.”

Meanwhile, some Capri followers were hopeful about a potential private equity buyout or acquisition, with one user speculating, “If it was worth $57 to Tapestry, someone else will take notice.”

Tapestry shares are up 52% year-to-date, buoyed by strong brand performance and strategic initiatives, while Capri has seen its stock plummet 63% in the same period.

For updates and corrections, email newsroom@stocktwits.com

Read next: Disney Stock Set To Hit 6-Month Highs After Upbeat Earnings: Retail Gets More Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)