Advertisement|Remove ads.

Hims & Hers Stock Sparks Retail Trader Frenzy After CEO Announces 'Largest Raise Yet' Of $1B

Shares of Hims & Hers Health, Inc. (HIMS) surged nearly 16% in Tuesday’s regular session and extended gains in after hours trading, ranking among the top trending tickers on Stocktwits as retail buzz spiked.

The momentum came after the telehealth company disclosed it had raised $1 billion last week, in its largest funding round to date.

According to an SEC filing, the offering comprised $870 million in 0.00% convertible senior notes due 2030, with the initial purchasers — Morgan Stanley and JP Morgan — exercising an option to buy an additional $130 million in notes by May 9.

CEO Andrew Dudum announced Hims’ “largest raise yet” on X (formerly Twitter), saying it was “more than double what we set out for,” thanks to strong investor demand.

“More than just a raise, it's a clear signal that people believe in what we’re building: a global healthcare platform that’s easy to use, affordable, and built around the individual,” he wrote.

Dudum said the company would use this capital to accelerate growth, including international expansion, scaling personalized care and deepening investment in artificial intelligence and data for precision healthcare.

“With this capital, we can move faster… much faster,” he said.

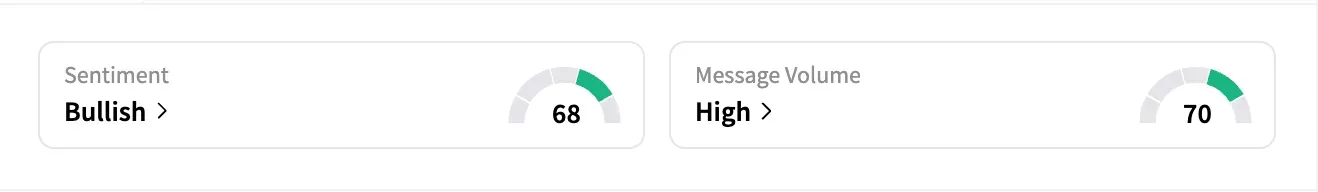

Retail sentiment for HIMS turned more ‘bullish’ on Stocktwits, with 24-hour message volume jumping over 31% by late Tuesday.

“Multi year hold. Triple digit stock easily. They will soak up more and more of the market. Hilarious to watch bears get smoked!” said one optimistic watcher.

"Shorts are cooked. HIMS's growth story is just starting," said another, sharing a screenshot of Dudum's social media post.

Hims & Hers shares have rallied more than 33% over the past week, fueled by a blowout first-quarter earnings report that showed revenue more than doubling to $586 million and earnings per share of $0.20, both easily topping analyst expectations.

The company also said its subscribers had jumped 38% year-over-year to 2.4 million.

Although Hims & Hers issued a conservative second-quarter revenue forecast of $530 million-$550 million, below Wall Street estimates, it reaffirmed full-year guidance and a long-term target of $6.5 billion in annual revenue by 2030.

HIMS stock is up over 150% this year but has also seen its short interest spike to 27.3% from 19.7% at the start of 2025, according to Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)