Advertisement|Remove ads.

Hershey Stock Dips After Short Report, Price–Target Cut: But Retail Isn’t Spooked Ahead Of Halloween

Shares of The Hershey Company ($HSY) dropped over 1.3% on Wednesday morning following a short report that raised concerns about potential health risks associated with its products and another bearish analyst note this week.

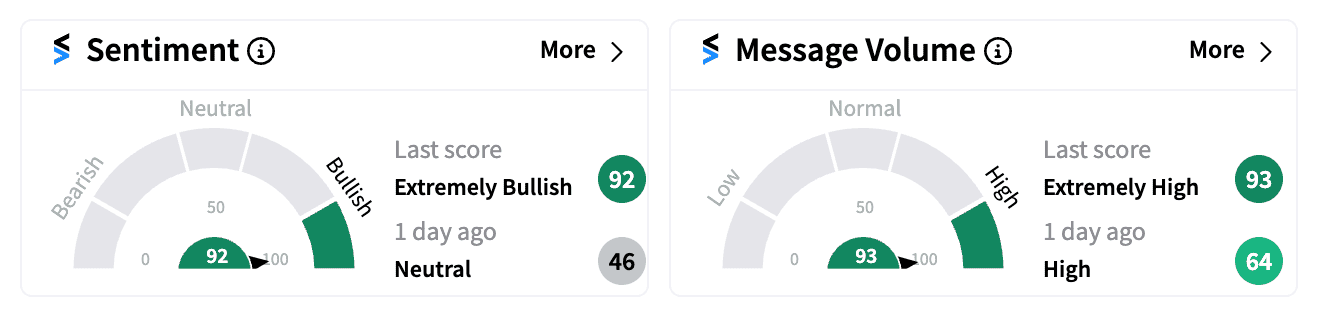

As of 10:30 AM ET, HSY was among the top 20 trending tickers on Stocktwits, reflecting heightened retail interest.

The sell-off was sparked by Grizzly Research’s short report, which claimed that independent tests found elevated levels of “forever chemicals” (PFAS) in the packaging of several Hershey products, including Reese’s Pieces, Almond Joy, and Hershey’s Kisses.

PFAS chemicals, commonly used in packaging coatings, are associated with health risks, including cancer, and are facing increasing regulation.

Adding to the bearish sentiment, Piper Sandler lowered its price target on Hershey from $179 to $165, maintaining a ‘Neutral’ rating, citing concerns over elevated cocoa prices that are likely to persist due to ongoing tree diseases impacting supply.

On Tuesday, Redburn Atlantic analyst Bingqing Zhu initiated coverage of Hershey with a ‘Sell’ rating and a $165 price target, citing multiple challenges including stagnant chocolate consumption, rising health concerns, and intensified competition.

Despite these headwinds, retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ the day prior, suggesting that investors are largely looking past the short report and analyst concerns.

This optimism is also likely fueled by the upcoming Halloween holiday, which typically boosts demand for Hershey’s iconic products like Reese’s Peanut Butter Cups and KitKat chocolates.

Total spending on candy for Halloween in 2024 is expected to reach $3.5 billion, according to a National Retail Federation survey.

Additionally, Hershey is addressing supply chain concerns by investing in a five-year agreement with nine cocoa-producing cooperatives in Côte d’Ivoire as part of its “Cocoa For Good” strategy.

However, HSY stock is still down more than 5% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

Read next: Winnebago’s Stock Set For Worst Day In 2 Years After Major Profit Miss: Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Falcon_9_jpg_f7456057f0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_market_crash_wikimedia_commons_eb7093dd9f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_Red_jpg_6e38585da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)