Advertisement|Remove ads.

HUL Shares Dip 3% After Q2 Earnings; Analyst Says ‘Wait For Clear Breakout’

- Hindustan Unilever posted modest Q2 earnings, with revenue rising 2% and net profit up 4%.

- HUL margins softened due to rising costs; the analyst flags cost pressures.

- Long-term investors are advised to accumulate, while traders should wait for a breakout.

Hindustan Unilever (HUL) shares fell over 3% on Friday on profit booking after the FMCG giant posted a modest earnings growth in the September quarter (Q2 FY26).

Net profit rose 4% to ₹2,685 crore, while revenue grew 2% to ₹16,241 crore. The company also announced an interim dividend of ₹19 per share, with the record date set for November 7 and payout on November 20.

However, margins took a slight hit. The EBITDA margin slipped to 23.2%, mainly due to higher costs. According to an SEBI-registered analyst, Mayank Singh Chandel, this is not alarming, but it shows that cost pressures remain for consumer goods companies. Underlying sales growth (USG) stood at 2%, with flat volume growth, as GST rate transitions and an extended monsoon impacted the quarter.

HUL: What Do Technical Charts Show?

HUL stock has been moving sideways since 2021. In September 2024, it tried to break its all-time high of ₹2,859.3 but failed and moved lower again.

Chandel noted that the stock is currently trading between its support and resistance zones, and the 200-day Exponential Moving Average (EMA) is moving up and down, indicating a lack of a clear trend.

What Should Traders Do?

If you’re a long-term investor, Chandel advised accumulating at current levels and adding more once it crosses ₹2,860. For traders, he said it’s better to wait for a clear breakout above ₹2,860 before entering any new position.

He concluded that even strong companies need time to build momentum, hence it would be prudent to wait and watch for now.

What Is The Retail Mood On Stocktwits?

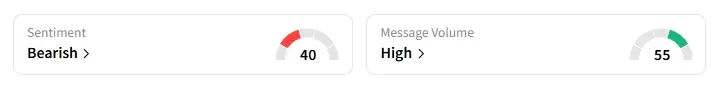

Data on Stocktwits showed that retail sentiment turned from ‘neutral’ to ‘bearish’ after the Q2 earnings print yesterday, amid ‘high’ message volumes.

HUL shares have risen 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)