Advertisement|Remove ads.

US Election 2024: BoFA Securities Revamps Ratings On Humana, UHS, Ardent, Oscar Health Stocks After Trump Win

Following Donald Trump’s election win, Bank of America (BoFA) Securities updated its ratings on several healthcare stocks, according to thefly.com, indicating a mixed outlook for the sector under the new administration.

Trump’s policies are anticipated to reshape healthcare, potentially easing regulatory pressures on Medicare Advantage providers like Humana, while casting uncertainties on other healthcare areas.

THE UPSIDE

BoFA Securities upgraded Humana ($HUM) from ‘Underperform’ to ‘Neutral,’ raising its price target from $247 to $308. Analysts see “dramatically improved” risk-reward dynamics for Humana, driven by potential for stronger reimbursement rates and diminished scrutiny on quality ratings and antitrust issues.

These factors could offer a pathway for stock appreciation, particularly as regulatory pressures ease.

Speculation is also mounting regarding a possible acquisition by Cigna ($CI) — rumored to be in pursuit of Humana.

With anticipated softer antitrust oversight under a Trump-led administration, BoFA suggests the likelihood of an acquisition has increased, providing additional valuation support for HUM.

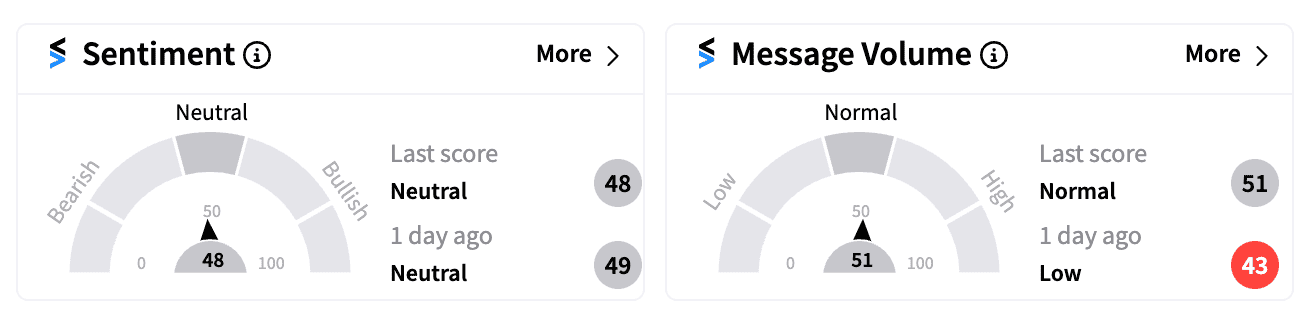

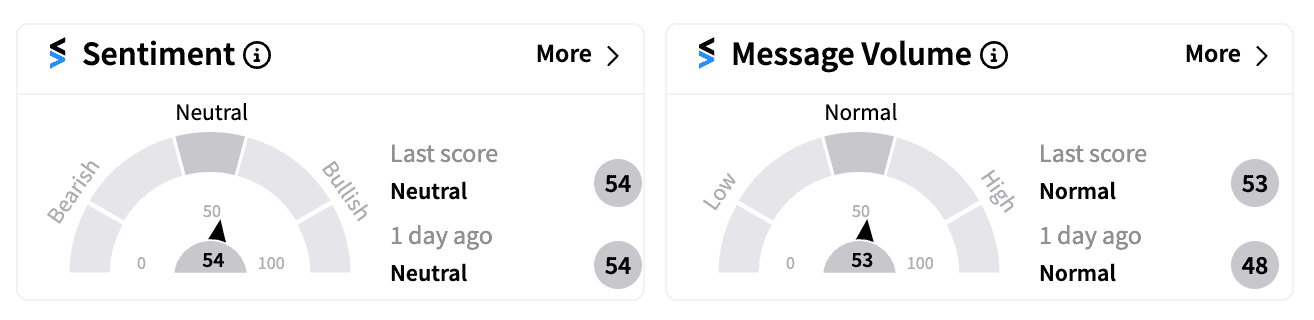

Humana shares surged nearly 10% by Wednesday afternoon, with Stocktwits retail sentiment holding steady at ‘neutral.’

STAYING CAUTIOUS

BoFA downgraded Universal Health Services ($UHS) and Ardent Health Services ($ARDT) to ‘Neutral’ from ‘Buy,’ citing concerns about the impact of Trump’s win on Medicaid supplemental payments and health exchanges.

The brokerage slashed UHS’s target from $259 to $223 and ARDT’s from $22 to $19, suggesting the current healthcare environment could become unfavorable for hospitals and healthcare facilities.

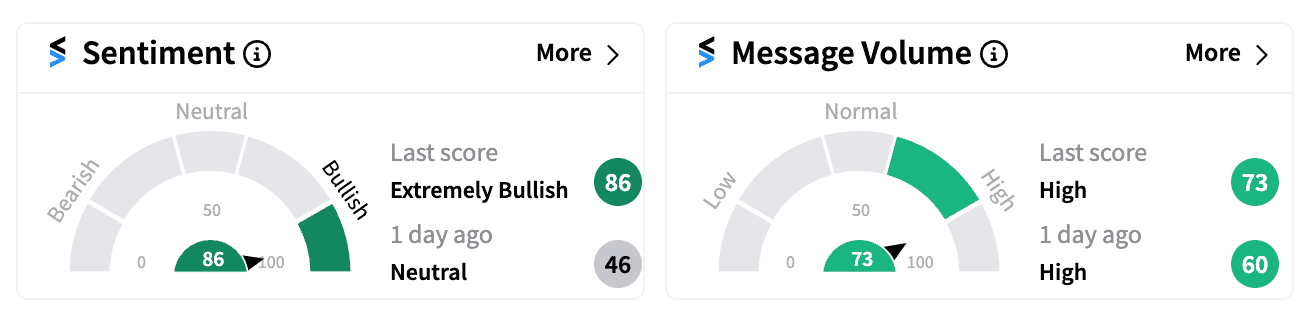

UHS fell over 4% in Wednesday afternoon trading with retail sentiment at ‘neutral,’ while ARDT dropped more than 9% with retail sentiment marked as ‘extremely bullish.’

RED FLAG?

On Oscar Health ($OSCR), BoFA downgraded the stock to ‘Underperform’ from ‘Neutral,’ lowering its price target from $21 to $13.50.

BoFA argues that the Trump administration’s stance will likely result in reduced support for exchange subsidies — the financial assistance provided to individuals and families who purchase health insurance through the Affordable Care Act (ACA) — creating significant headwinds for Oscar Health.

Lowering its 2027 EPS estimate by to $0.85 (60% below consensus), BoFA foresees valuation pressure as Congress revisits subsidy policies and as enrollment peaks in 2026.

The brokerage sees some near-term strength on quarterly results but “expects valuation to be capped as one approaches the subsidy debate in congress and enrollment cliff in 2026.”

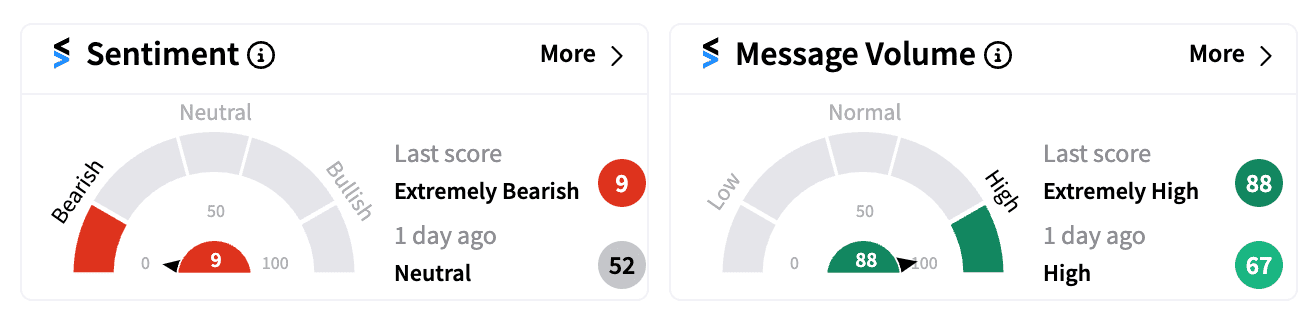

OSCR shares plummeted over 14% Wednesday, with retail sentiment plunging to ‘extremely bearish’ — the lowest level recorded this year.

For updates and corrections, email newsroom@stocktwits.com

Read next: US Election 2024: Here’s Why Bank Stocks Are Rising After Trump's Victory

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)