Advertisement|Remove ads.

US Election 2024: Here’s Why Bank Stocks Are Rising After Trump's Victory

Bank stocks rallied on Wednesday after Donald Trump emerged victorious in the U.S. presidential election, with traders factoring-in less stricter financial regulation.

Among the top banking names, Wells Fargo & Co ($WFC) jumped over 14% while Goldman Sachs Group Inc ($GS) and Morgan Stanley ($MS) recorded gains of over 12%.

Citigroup Inc ($C) and Bank of America ($BAC) rose nearly 9% during Wednesday’s trade. JPMorgan Chase & Co ($JPM) shares rallied nearly 11%.

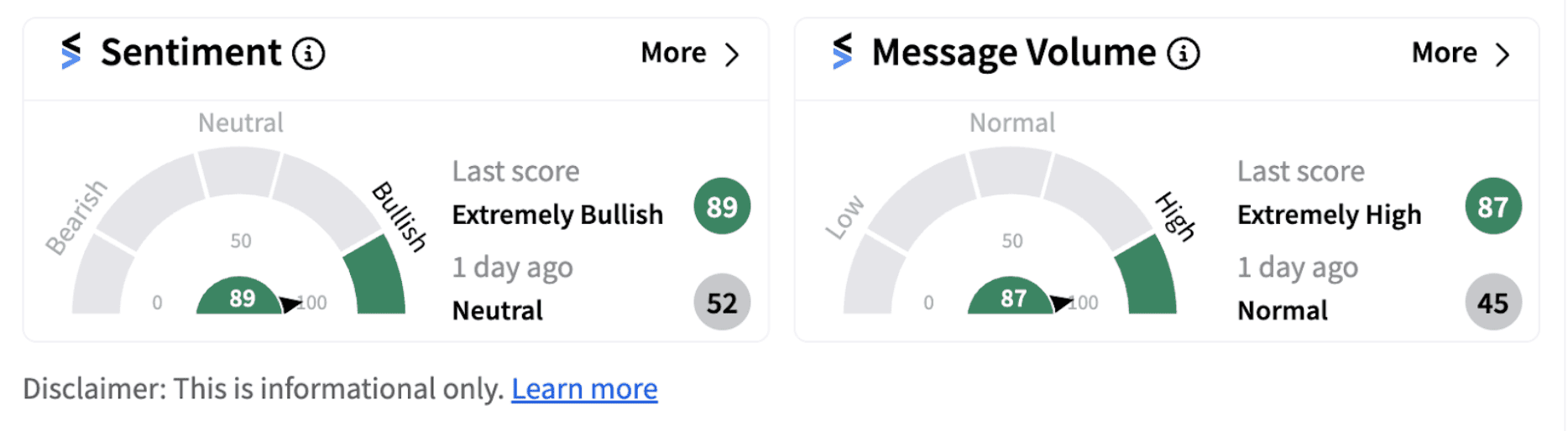

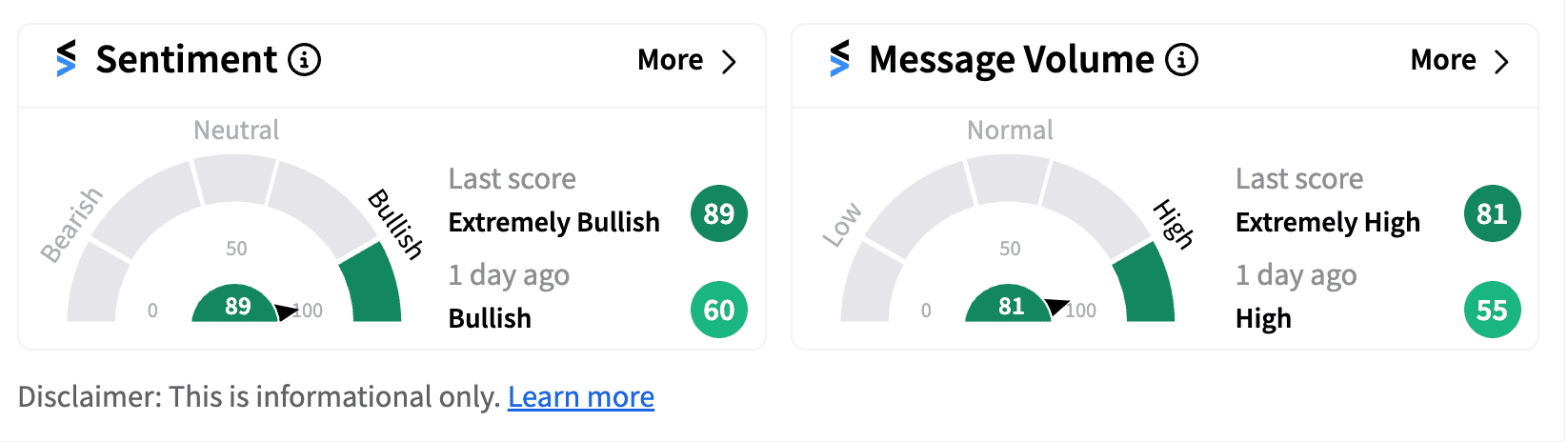

Retail sentiment was trending in the ‘extremely bullish’ territory for both Goldman Sachs and Citigroup while other lenders too saw bullish takes by investors.

Banks have been asking for less stringent regulation with lower capital requirements. Earlier this year, Wall Street lenders won a small victory when the extra capital requirement was brought down by regulators in September.

"Markets seem to have accepted that another Trump term would mean a supportive and expansionary fiscal policy, which could positively impact growth in the U.S.," said Daniela Sabin Hathorn, senior market analyst at Capital.com, according to a MarketWatch report.

Investors are also considering the situation where the Trump administration would follow a light-touch approach to regulation, according to a Financial Times report.

Banks had been reporting higher profits as interest rates remained high over the last few years. Of late, with the commencement of the policy easing cycle, the prospects of making such huge profits had diminished.

Meanwhile, shares of other lenders also joined Wednesday’s rally. Discover Financial Services ($DFS) and Synchrony Financial ($SYF) stocks soared over 18% while Capital One Financial Corp. ($COF) shares rose over 14%.

Also See: US Election 2024: VIX Crashes On Wednesday As Traders Find Solace In Certainty Post Trump Victory

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)