Advertisement|Remove ads.

IBM-HSBC Quantum Technology Trial Optimizes Bond Trading – More Details Inside

IBM (IBM) stock gained over 5% on Thursday mid-morning after HSBC Holdings plc (HSBC) revealed results from a breakthrough quantum computing experiment conducted alongside the tech giant.

The experiment offers the first documented evidence of quantum systems improving real-world bond trading outcomes. The collaboration focused on the European corporate bond market, where HSBC reported that integrating quantum computing with traditional models yielded up to a 34% improvement in predicting the likelihood of trades being executed at quoted prices.

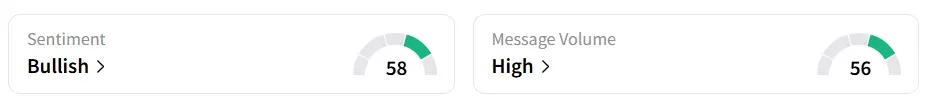

On Stocktwits, retail sentiment around IBM stock jumped to ‘bullish’ territory from ‘bearish’ the previous day. Message volume levels improved to ‘high’ from ‘normal’ levels in 24 hours.

A Stocktwits user sounded optimistic about the experiment.

Another bullish user highlighted IBM's financial stability.

HSBC utilized IBM’s quantum computers, specifically its latest processor, Heron, to enhance decision-making in over-the-counter bond markets, where assets are traded directly between parties without the use of centralized exchanges. HSBC and IBM’s hybrid method combined quantum and classical resources to more effectively identify pricing signals hidden in market data, improving algorithmic strategies in a complex environment.

The aim is to determine the probability of securing a trade at a specific price while reducing risk. HSBC’s trial showed that quantum systems could refine this process beyond what standard computing approaches currently achieve.

IBM’s quantum machines, accessible via the cloud and powered by its open-source software stack Qiskit, allow real-world experimentation on financial data.

IBM stock has gained over 28% year-to-date and over 27% in the last 12 months.

Also See: Amazon Reaches $2.5 Billion Settlement With FTC Over Prime Subscription Case: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)