Advertisement|Remove ads.

Opendoor Stock Beats Last Week’s Blues, Early Warrant Trades Show Bullishness: Retail Mood Neutral

- The price of each of the three Opendoor warrants rose on Monday, with the largest gain in the one with the highest exercise price.

- Opendoor distributed its special ‘KAZ’ warrants last Friday, with OPEN shares declining significantly in the lead-up.

- OPEN shares gained 14% on Monday.

Trading in Opendoor Technologies, Inc.’s stock has been complicated recently by the special warrants issue, but the latest signals point to an upward trend.

For one, OPEN stock closed nearly 14% higher at $7.69 on Monday. It had gained 9.6% on Friday, following a six-session decline. And now, with the warrants – three, namely, OPENW, OPENL, and OPENZ – trading on the Nasdaq, there’s another, separate play to keep an eye on.

Warrant Trades

The price of each of those warrants increased in Monday’s trading, according to TradingView, with top gains in the series with the highest exercise price. Warrants amplify directional bets, and traders who buy them typically expect the underlying stock to rise.

OPENW – the K series, which allows holders to buy Opendoor stock for $9 a piece – gained 1.1% to $1.82, compared to the opening price of $1.80.

Similarly, OPENL (series A, with an exercise price of $13) also gained 1.1% to $1.08, while OPENZ (series Z, with an exercise price of $17) gained by over 27% to $0.65.

Opendoor distributed the warrants on Nov. 21, and they expire on Nov. 20, 2026.

Retail’s View

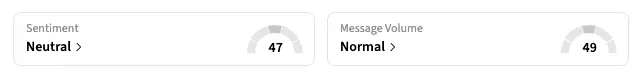

On Stocktwits, the retail sentiment for OPEN has remained ‘neutral’ so far this week.

“$OPEN hold your shares. Hold your warrants. It’s really that simple,” a user advised, with several others forecasting gains in warrant prices.

Meanwhile, the growing expectation of a Federal Reserve rate cut at its December review, which would be a huge boost for the real estate market and, in turn, Opendoor, is also lending momentum to the stock, retail traders said.

Not everybody is on board, though, especially the old guard. CNBC’s Jim Cramer said recently, “The stock is high given the fact that the company makes no money. I’m not a believer until it makes money.”

Legal Chief Sells Stock

In a separate development, Opendoor’s chief legal officer, Sydney Schaub, has filed to sell $4.1 million worth of Opendoor stock, according to an exchange filing on Monday. In the last three months, she has sold shares worth a little over $1 million.

As of the last close, OPEN stock is down about 27% from its Sept. 11 peak, but is still up 373% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Sam Altman Eyes ‘iPhone Moment’ With OpenAI’s Forthcoming AI Device, But It's Still 2 Years Away

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)