Advertisement. Remove ads.

ImmunityBio Stock Heats Up, Catches Retail's Eye On Cancer Drug Trial Progress And Analyst’s Bullish Call

Shares of ImmunityBio Inc. ($IBRX) surged over 45% on Friday, ranking among the top five gainers on U.S. exchanges and trending on Stocktwits.

The San Diego-based biotech has drawn retail interest this week, fueled by two key catalysts related to its cancer treatment pipeline.

On Thursday, ImmunityBio announced the dosing of its first patients in an early-stage CAR-NK cell therapy trial aimed at CD19 for treating non-Hodgkin’s lymphoma (NHL).

Conducted across Johannesburg, Pretoria, and Bloemfontein, South Africa, the Phase 1, open-label trial is expected to enroll 10 participants, marking South Africa’s first study involving cellular-targeted NK therapy.

"This trial is important for ImmunityBio as our first clinical study of our CAR-NK, CD19 t-haNK cell line, as well as one of our first studies in liquid tumors," said Patrick Soon-Shiong, M.D., Executive Chairman, Founder and Global Chief Scientific and Medical Officer at ImmunityBio.

On Wednesday, EF Hutton initiated coverage on ImmunityBio with a ‘Buy’ rating and a $30 price target, suggesting a fivefold potential from current levels.

The brokerage’s analyst emphasized ImmunityBio’s “triangle offense” strategy, suggesting its leading drug, Anktiva, could revolutionize cancer immunotherapy.

While Anktiva’s primary indication is bladder cancer, its effects could extend to other solid tumors that respond well to checkpoint inhibitors.

Anktiva, designed to boost the immune system’s tumor-fighting response, was FDA-approved in April for patients with non-muscle invasive bladder cancer unresponsive to BCG.

Beyond bladder cancer, ImmunityBio aims to reduce chemotherapy reliance by advancing cancer vaccines and immunotherapies.

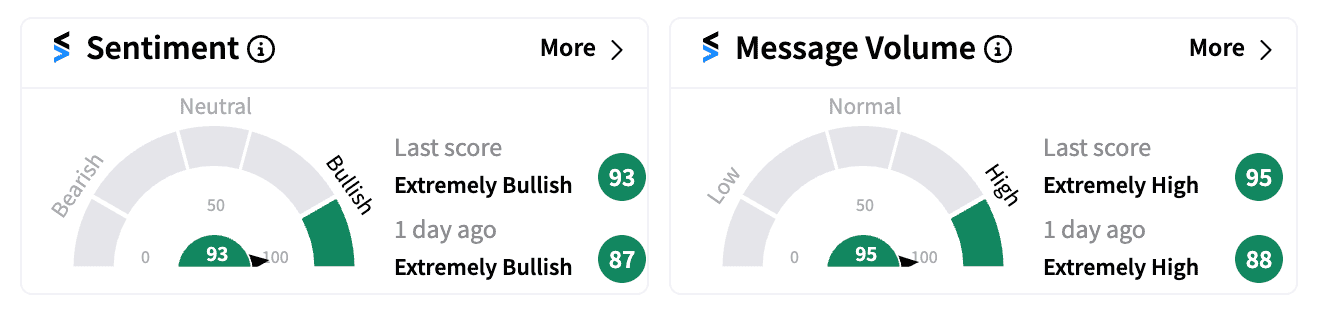

The stock’s popularity on Stocktwits has surged, with a 37% increase in followers over the past year and a 450% rise in message volume over the last month.

Retail sentiment for IBRX remained ‘extremely bullish’ on Friday afternoon.

However, financial challenges persist. ImmunityBio reported a net loss of $134.6 million last quarter, only slightly lower than the previous year’s $137.9 million.

Cash reserves stand at $130.1 million, down from $265.5 million a year ago.

Still, IBRX stock is up nearly 14% year-to-date, with a market capitalization of just under $3 billion.

For updates and corrections email newsroom@stocktwits.com

Read Next: Palantir Stock Reaches Record High On Strategic Deal With L3Harris, Driving Retail Buzz

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/img-20250906-wa0020-2025-09-5eb06bd17ff7f09275c65cf5224cebaf.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/03/cars-auto-sales-trade-2025-03-112a2d39607959bc768b9aab6126e355.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/anand-singha-thumnails-90-2025-02-69074ef2fa5040cebb8fe5d51a8f98e4.jpg)