Advertisement|Remove ads.

IHC backing validates management, marks new chapter for Sammaan Capital: Gagan Banga

Gagan Banga, MD & CEO of Sammaan Capital, said that strategically, the company considered reinventing itself. After last year’s equity raise, the organisation stabilised and was gradually returning to business as usual. To drive growth and capitalise on opportunities in India, he believes the next 20 years—aligned with the Prime Minister’s vision of Viksit Bharat—are extremely promising.

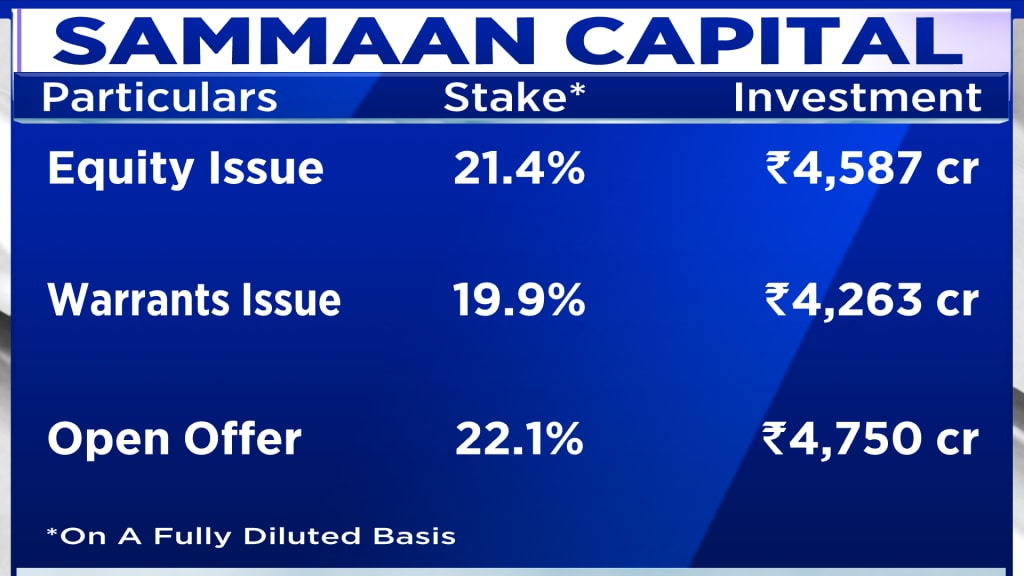

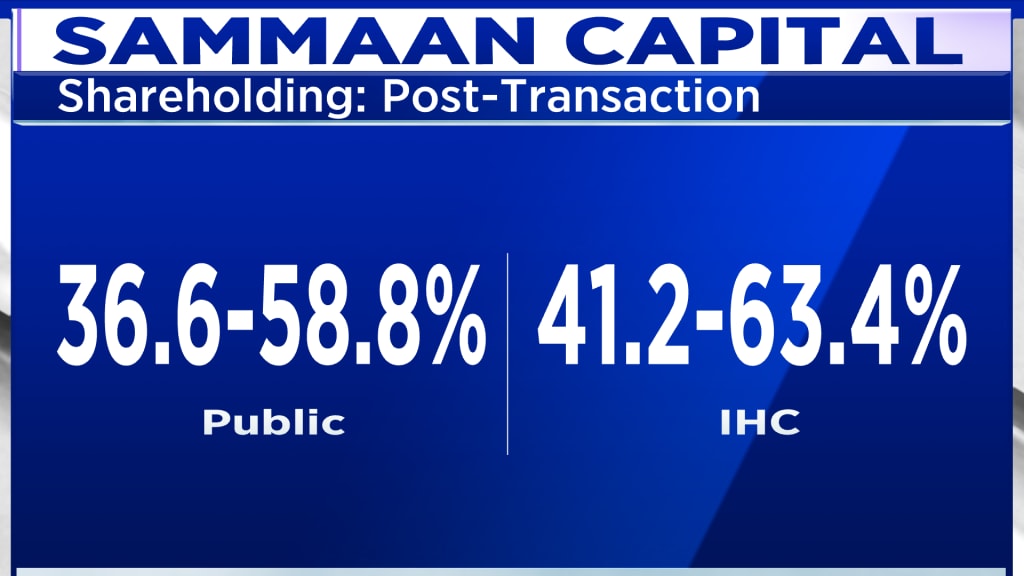

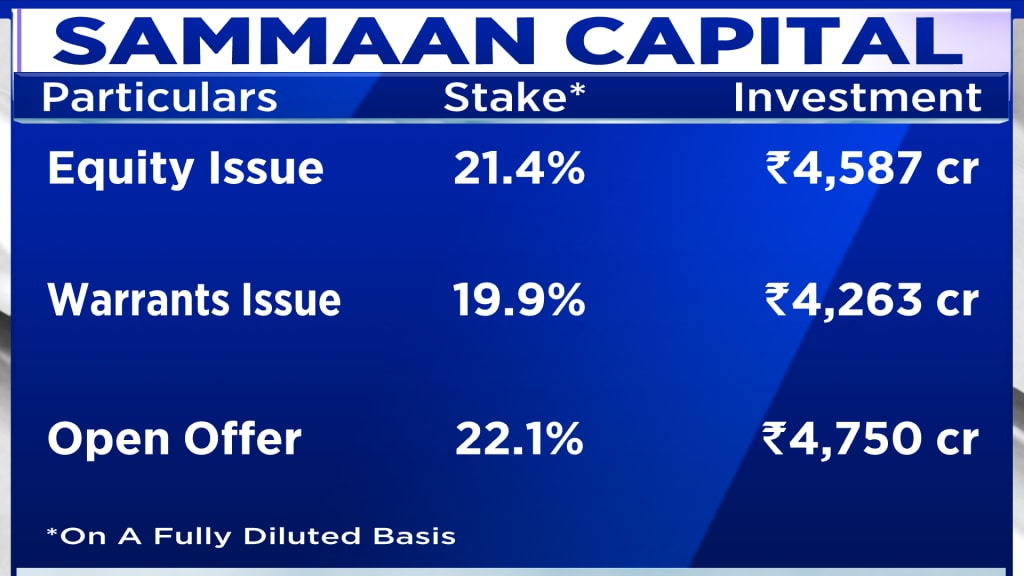

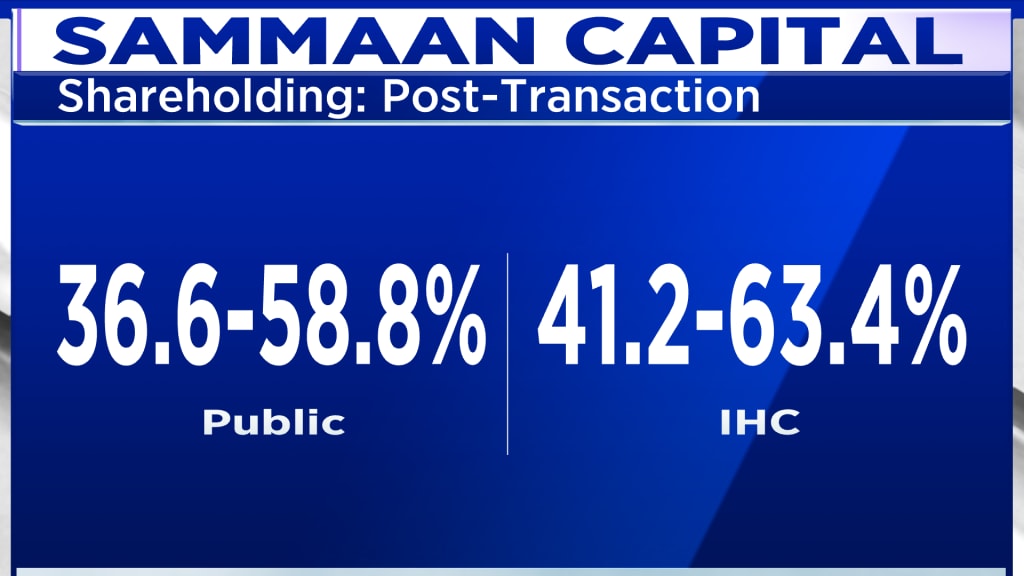

Abu Dhabi-based IHC has entered into a definitive agreement to acquire a controlling 41.2% stake in Sammaan Capital in a $ 1 billion deal, signalling a fresh chapter for the NBFC.

The investment comes after years of turbulence following the IL&FS crisis, providing a clean slate and strong validation of the company’s management team, according to its leadership.

The market capitalisation of Sammaan Capital is around ₹13,427.76 crore. Its shares have gained close to 2% in the past year.

Below are the edited excerpts from the interview.

Q: You got IHC as promoter, right?

A: Yes.

Q: Abu Dhabi's IHC entered into a definitive agreement to acquire a controlling stake of 41.2%. It is a big $1-billion deal, very large. Before we get into the specifics of how this will play out, to your mind, do you think some of the past issues with Indiabulls Housing—all that—is now behind us? Are we starting with a clean slate with the new promoter coming in, I mean, changing hands in that sense?

A: My big-picture theory is that when large financial services companies—banks, non-banking financial companies (NBFC), whatever—have to hit a deep reset button, it takes six to eight years to reconfigure. It’s a large balance sheet. It took us our time. It’s been seven years since the IL&FS crisis started, which, with a lag effect, did affect us, but we kept putting one foot in front of the other.

I think this investment, for me, is beyond just an investment—it’s a victory and a validation of the management team. They are clearly backing the management team, and I am happy they have put so much faith in professional individuals.

Q: The management team remains the same?

A: Yes. Their whole idea, and why this is such an important transaction, is that, unlike a typical fund transaction, they are looking at this investment in perpetuity. They don’t have a fund life or exit timeline. This is their India financial services foray.

Also Read: Sammaan Capital shares fall 5% after six-day winning run on IHC deal; Stock in F&O ban

Second, they want to govern the company with a board-driven framework, and management is accountable to the board and other stakeholders, rather than the investor joining the management team. At least, that’s what is visualised right now.

Q: In terms of the transaction itself—outbound or inbound—did you go looking for an investor? How long did this take? And why IHC?

A: These transactions take time. Strategically, we considered reinventing the organisation. After last year’s equity raise, the organisation stabilised and was slowly returning to business as usual. To get back to growth and take advantage of opportunities in the country, I strongly believe the next 20 years, aligned with the Prime Minister’s vision of Viksit Bharat, are super exciting. These are perhaps the last 10–15 years of my professional life, so I needed a partner. Without getting into specifics of who approached whom, we found each other.

Q: Once approvals come through, which you mentioned would take six to 12 months, what happens next? IHC is bringing in ₹8,850 crore. How will this affect capital adequacy and business segments?

A: First, what does this money do for us? Often, people think about equity only in terms of capital adequacy. It’s beyond that—it’s the foundation on which you build a debt-backed structure. We are ultimately a conduit: we borrow and we lend. The solidity of the building depends on the strength of the equity foundation.

Right now, we have a solid promoter, as solid as can be, enabling us to build a credible liability franchise. The struggles of the last seven years were manageable because our liability franchise was strong. By 2018, it was diversified, had duration, and we could manage. From a growth perspective, with efficient capital—low cost, diversified domestically and internationally—we quietly built a retail bondholder base of almost 100,000 people, which can easily scale to a million. The first objective is efficiency and optimisation of the cost of capital.

Q: With this equity foundation, do you need further equity raises?

A: The equity part is fully taken care of. We were already well capitalised with a capital adequacy of close to 30%, so this was not about capital requirement—it was about partnership and reinvention. Building four pieces of debt on this equity would have cost 150–170 basis points more than it will prospectively, so this reduces our cost of capital by about 150 bps. 150-170, to the layman, may mean nothing, but for m,e it is the whole spread.

Also Read: Abu Dhabi's IHC to acquire 43.5% stake in India's Sammaan Capital in ₹8,850 crore deal

Q: So, going forward, your cost of capital, basically, should come down by 150 bps?

A: I estimate that 12 or 18 months from now, six months after the approval, we should be 170 bps lower.

Q: Regarding book value, it was around ₹260 before this deal. Post-transaction, rough estimates suggest it comes down to ₹210. Would that be fair?

A: Yes. That’s correct.

Q: So, you will be focusing on growth, cost of capital goes down. What is your targeted ROE for the business?

A: Ideally, on average, 15–17%, potentially going up to 20% by 2030. Capital adequacy will be 20–25% by then, with ROA in the ballpark of 3.5%.

Q: About the legacy book, which is mid-30% of your portfolio, how will that be managed?

A: Practically the entire legacy book is secured, backed by property or similar collateral. The focus is now on growth rather than overemphasising legacy issues. Collections are set: we aim for ₹10,000 crore cash collections this financial year. The message to borrowers is clear—they won’t be cornered, but obligations will be enforced.

Q: Couple of quarters down the line, will there be a need to get some of the legacy stuff out, kind of thing? You have the capital for it to do it now.

A: That is strategic stuff. So, two quarters from now, we will stop differentiating between legacy and growth books—the book will just be one book, fully manageable. Tools are available to optimise management.

Q: Credit ratings? JPMorgan expects a two-to-three-notch uplift post-transaction. Is that your expectation too?

A: Yes. We are engaged with rating agencies. I expect us to be at par with sovereign ratings in 18 months.

Q: RBI approval—any concerns due to IHC or the royal family connection?

A: IHC is a large, publicly listed company. RBI will conduct a 360-degree evaluation, but I don’t expect any extraordinary hurdles.

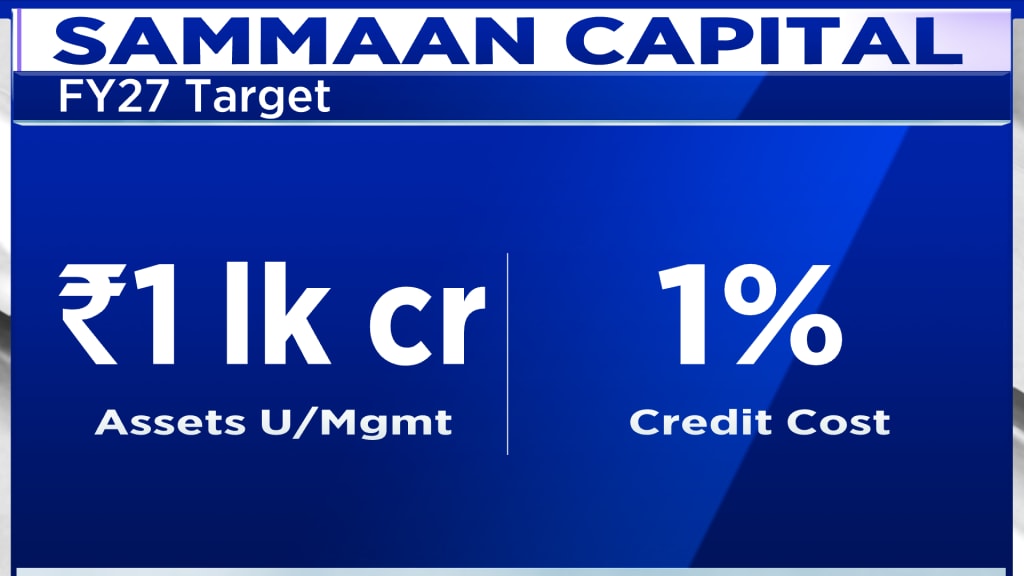

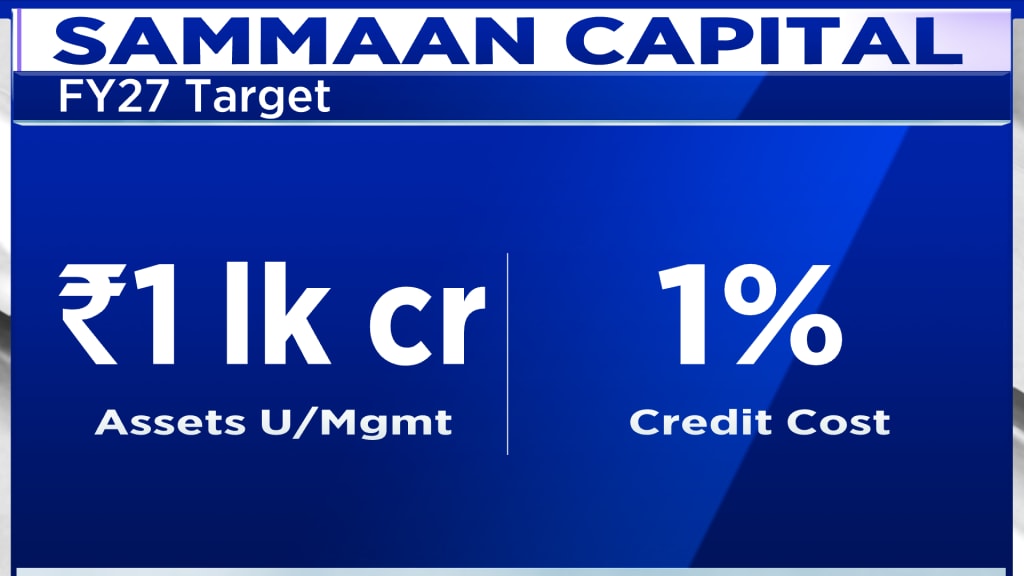

Q: Current book is around ₹63,000–64,000 crore, with a target of ₹1 lakh crore by 2026-27 (FY27). What will the composition look like?

A: Over the next 12–18 months, we will continue with our target segment: mid- to lower-income groups. Lending requirements of that segment will be evaluated, and non-lending services like insurance will be built out in partnership. Asset-light strategy continues. All lending services will remain on our balance sheet.

Q: Target credit cost on a run-rate basis?

A: 100 bps.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

The investment comes after years of turbulence following the IL&FS crisis, providing a clean slate and strong validation of the company’s management team, according to its leadership.

The market capitalisation of Sammaan Capital is around ₹13,427.76 crore. Its shares have gained close to 2% in the past year.

Below are the edited excerpts from the interview.

Q: You got IHC as promoter, right?

A: Yes.

Q: Abu Dhabi's IHC entered into a definitive agreement to acquire a controlling stake of 41.2%. It is a big $1-billion deal, very large. Before we get into the specifics of how this will play out, to your mind, do you think some of the past issues with Indiabulls Housing—all that—is now behind us? Are we starting with a clean slate with the new promoter coming in, I mean, changing hands in that sense?

A: My big-picture theory is that when large financial services companies—banks, non-banking financial companies (NBFC), whatever—have to hit a deep reset button, it takes six to eight years to reconfigure. It’s a large balance sheet. It took us our time. It’s been seven years since the IL&FS crisis started, which, with a lag effect, did affect us, but we kept putting one foot in front of the other.

I think this investment, for me, is beyond just an investment—it’s a victory and a validation of the management team. They are clearly backing the management team, and I am happy they have put so much faith in professional individuals.

Q: The management team remains the same?

A: Yes. Their whole idea, and why this is such an important transaction, is that, unlike a typical fund transaction, they are looking at this investment in perpetuity. They don’t have a fund life or exit timeline. This is their India financial services foray.

Also Read: Sammaan Capital shares fall 5% after six-day winning run on IHC deal; Stock in F&O ban

Second, they want to govern the company with a board-driven framework, and management is accountable to the board and other stakeholders, rather than the investor joining the management team. At least, that’s what is visualised right now.

Q: In terms of the transaction itself—outbound or inbound—did you go looking for an investor? How long did this take? And why IHC?

A: These transactions take time. Strategically, we considered reinventing the organisation. After last year’s equity raise, the organisation stabilised and was slowly returning to business as usual. To get back to growth and take advantage of opportunities in the country, I strongly believe the next 20 years, aligned with the Prime Minister’s vision of Viksit Bharat, are super exciting. These are perhaps the last 10–15 years of my professional life, so I needed a partner. Without getting into specifics of who approached whom, we found each other.

Q: Once approvals come through, which you mentioned would take six to 12 months, what happens next? IHC is bringing in ₹8,850 crore. How will this affect capital adequacy and business segments?

A: First, what does this money do for us? Often, people think about equity only in terms of capital adequacy. It’s beyond that—it’s the foundation on which you build a debt-backed structure. We are ultimately a conduit: we borrow and we lend. The solidity of the building depends on the strength of the equity foundation.

Right now, we have a solid promoter, as solid as can be, enabling us to build a credible liability franchise. The struggles of the last seven years were manageable because our liability franchise was strong. By 2018, it was diversified, had duration, and we could manage. From a growth perspective, with efficient capital—low cost, diversified domestically and internationally—we quietly built a retail bondholder base of almost 100,000 people, which can easily scale to a million. The first objective is efficiency and optimisation of the cost of capital.

Q: With this equity foundation, do you need further equity raises?

A: The equity part is fully taken care of. We were already well capitalised with a capital adequacy of close to 30%, so this was not about capital requirement—it was about partnership and reinvention. Building four pieces of debt on this equity would have cost 150–170 basis points more than it will prospectively, so this reduces our cost of capital by about 150 bps. 150-170, to the layman, may mean nothing, but for m,e it is the whole spread.

Also Read: Abu Dhabi's IHC to acquire 43.5% stake in India's Sammaan Capital in ₹8,850 crore deal

Q: So, going forward, your cost of capital, basically, should come down by 150 bps?

A: I estimate that 12 or 18 months from now, six months after the approval, we should be 170 bps lower.

Q: Regarding book value, it was around ₹260 before this deal. Post-transaction, rough estimates suggest it comes down to ₹210. Would that be fair?

A: Yes. That’s correct.

Q: So, you will be focusing on growth, cost of capital goes down. What is your targeted ROE for the business?

A: Ideally, on average, 15–17%, potentially going up to 20% by 2030. Capital adequacy will be 20–25% by then, with ROA in the ballpark of 3.5%.

Q: About the legacy book, which is mid-30% of your portfolio, how will that be managed?

A: Practically the entire legacy book is secured, backed by property or similar collateral. The focus is now on growth rather than overemphasising legacy issues. Collections are set: we aim for ₹10,000 crore cash collections this financial year. The message to borrowers is clear—they won’t be cornered, but obligations will be enforced.

Q: Couple of quarters down the line, will there be a need to get some of the legacy stuff out, kind of thing? You have the capital for it to do it now.

A: That is strategic stuff. So, two quarters from now, we will stop differentiating between legacy and growth books—the book will just be one book, fully manageable. Tools are available to optimise management.

Q: Credit ratings? JPMorgan expects a two-to-three-notch uplift post-transaction. Is that your expectation too?

A: Yes. We are engaged with rating agencies. I expect us to be at par with sovereign ratings in 18 months.

Q: RBI approval—any concerns due to IHC or the royal family connection?

A: IHC is a large, publicly listed company. RBI will conduct a 360-degree evaluation, but I don’t expect any extraordinary hurdles.

Q: Current book is around ₹63,000–64,000 crore, with a target of ₹1 lakh crore by 2026-27 (FY27). What will the composition look like?

A: Over the next 12–18 months, we will continue with our target segment: mid- to lower-income groups. Lending requirements of that segment will be evaluated, and non-lending services like insurance will be built out in partnership. Asset-light strategy continues. All lending services will remain on our balance sheet.

Q: Target credit cost on a run-rate basis?

A: 100 bps.

For the entire interview, watch the accompanying video

Catch all the latest updates from the stock market here

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_mumbai_city_jpg_607ef7484f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bumble_HQ_original_jpg_2b5a2acef3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wework_jpg_a1ffb0ea24.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nissan_jpg_bf0abb3fd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_Floor_jpg_740cf0587e.webp)