Advertisement|Remove ads.

After A Year Of Correction, Indus Towers May Be Poised For A Rally — SEBI Analyst Explains Why

Indus Towers, a subsidiary of Bharti Airtel, has been rangebound over the last month, with its shares rising only 4%. However, technical indicators suggest that the stock may mark the beginning of a new bull run.

SEBI-registered analyst Aditya Thukral noted that the stock has been reversing after experiencing a corrective phase of almost a year.

Indus Towers’ stock broke the combination of lower highs and lower lows, ending the phase of downtrend. A climax selling event was witnessed on September 3, where stock prices formed a pinbar reversal pattern, accompanied by the highest daily volumes in almost a year.

Thukral said that Indus Towers has formed a higher high and is in the process of confirming the formation of a higher low of ₹340.90. He believes that this marks the beginning of a fresh reversal for the stock.

Technicals Suggest Fresh Rally

On the technical charts, Indus Towers is regaining its position above its 20-day and 50-day exponential moving averages (EMAs), while the 100-day and 200-day EMAs remain in the range of ₹363 to ₹363.50. A falling trendline breakout was observed in the stock prices, and the same has occurred in the RSI. This appears to be the beginning of a bull market in stock prices, where the current entry offers the lowest risk, according to Thukral.

Trade Idea

Thukral advised that bulls can play a reversal in stock prices by maintaining a stop loss of ₹340 and a minimum target price of ₹398 within the next month.

Q2 Preview

JM Financial expects a subdued quarter from the telecom companies. For Indus Towers, a healthy net tenancy addition is likely, driven by Bharti’s rural expansion and Vodafone Idea’s network rollouts.

What Is The Retail Mood?

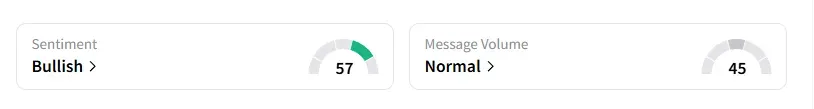

Data on Stocktwits indicates that retail sentiment shifted to ‘bullish’ a day ago. It was ‘neutral’ last week.

Indus Towers’ shares have risen 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)