Advertisement|Remove ads.

IndusInd Bank Stock: SEBI Analyst Warns Of More Downside Amid Nifty50 Exit

IndusInd Bank has been in a clear downtrend since mid-July, with consistent lower highs and lower lows. Over the past month, the stock has declined nearly 6%.

Technical indicators remain bearish, and the stock is consolidating near lower price levels. SEBI-registered analyst Deepak Pal added that IndusInd Bank’s exit from the Nifty50 index, effective from September 30, may negatively impact short-term market sentiment.

Technical Watch

He noted that the stock was trading well below its key moving averages, reflecting a strong bearish momentum. The Parabolic SAR dots remain above the price, confirming ongoing selling pressure.

The MACD is in a negative territory with a weak histogram, showing no signs of bullish crossover yet. The Relative Strength Index (RSI) stands at around 37, which shows that the stock was in the lower zone but not yet in oversold territory, suggesting that further downside cannot be ruled out.

Trading Strategy

Pal identified immediate support near ₹735, with the next supports at ₹725–720. Resistance is seen around ₹755–765 levels. Sustained trade below support could open room towards ₹700, while only a breakout above resistance may bring relief for IndusInd Bank

News Triggers

CRISIL has recently reaffirmed the bank’s long-term rating as AA+/Negative but cautioned on short-term risks.

Accounting discrepancies and irregularities discovered in early 2025 led to regulatory scrutiny and loss of investor trust. This was followed by leadership uncertainty due to the resignation of the CEO. The appointment of a new leader in charge, along with RBI-approved senior management changes, has added to the market uncertainty.

Moreover, earnings showed a decline in profit after tax (PAT) due to margin pressure and increased provisions. The bank reported a significant net loss last quarter mainly because of issues in derivatives and accounting lapses, leading to weak investor sentiment.

What Should Traders Do?

Going ahead, Pal said that short-term recovery for the stock depends on management clarity, the impact of the index change, and stable financial results. But he cautioned long-term investors to monitor financial risks and sectoral performance carefully.

What Is The Retail Mood?

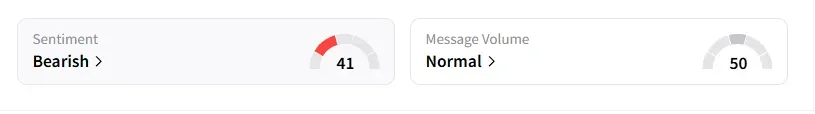

Data on Stocktwits shows that retail sentiment has moved to 'bearish' from ‘neutral’ this week.

IndusInd Bank shares have declined 24% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)