Advertisement|Remove ads.

Inflation Report Is Out, Traders Factor In Three 25 Bps Rate Cuts By December

Investor sentiment brightened after Tuesday’s inflation data, sending U.S. stocks higher at the open and fueling bets on three Fed rate cuts this year.

The CME FedWatch tool shows traders are considering a 92.2% probability of a 25 basis point rate cut in September and a 62.4% probability of another quarter-point reduction in October. In December, too, traders expect the central bank to cut rates by another 25 bps, with the probability at 51%. This is higher than Monday’s readings of 85.9%, 55.1%, and 45%, respectively.

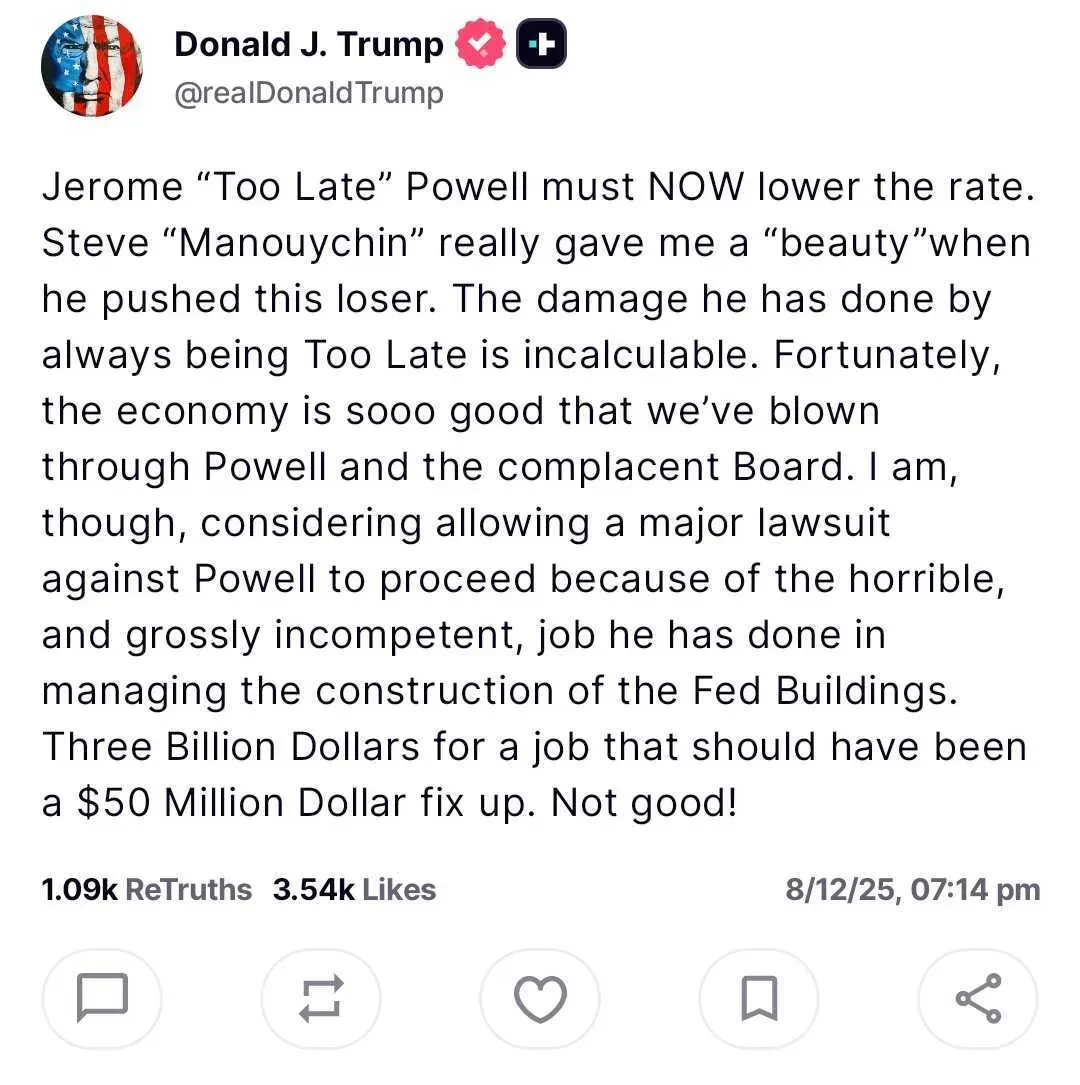

President Donald Trump reiterated the urgency for a rate cut on Tuesday in a post on Truth Social after the inflation report was released. "Jerome 'Too Late' Powell must NOW lower the rate," he wrote. "The damage he has done by always being Too Late is incalculable." Trump also suggested he may allow a lawsuit over alleged mismanagement of a Fed building renovation to proceed.

The Bureau of Labor Statistics’ July inflation report showed a softer-than-expected increase in consumer prices. Goldman Sachs and JPMorgan analysts had projected a 2.8% year-over-year rise in the Consumer Price Index (CPI), up from 2.7% in June. Instead, CPI held steady at 2.7%. Core inflation, which excludes food and energy, rose to 3.1%, landing at the higher end of forecasts.

According to Richmond Fed President Thomas Barkin, it remains unclear whether the Federal Reserve will prioritize inflation control or support for the labor market, even though uncertainty over the U.S. economic outlook is easing.

“The fog is lifting,” Barkin said on Tuesday at an event in Chicago as reported by Bloomberg. He noted that tax legislation, tariff agreements, as well as consumer and business sentiment, were improving.

“We may well see pressure on inflation, and we may also see pressure on unemployment, but the balance between the two is still unclear,” Barkin noted. “As the visibility continues to improve, we are well positioned to adjust our policy stance as needed.”

U.S. equity markets gained after July inflation data showed price growth holding steady. The SPDR S&P 500 ETF (SPY) rose 0.56%, and the SPDR Dow Jones Industrial Average ETF (DIA) gained nearly 1%. The Invesco QQQ Series 1 Trust (QQQ), which tracks the tech-heavy Nasdaq 100, was up 0.52%. However, retail sentiment on Stocktwits around the S&P 500 ETF remained in ‘neutral’ territory.

Read also: Ethereum’s Price Tops $4,400 For First Time Since 2021 After BMNR Plans Another $20B ETH Buy

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)