Advertisement|Remove ads.

Instacart Stock Slumps After-Market Following Q4 Revenue Miss: Retail Sentiment Sours

Instacart shares dropped nearly 10% in after-hours trading on Tuesday after the company posted a fourth-quarter revenue miss, dampening retail sentiment.

For Q4, its earnings per share came in at $0.53, beating expectations of $0.38; but revenue missed expectations, coming in at $883 million compared to the $891.05 million estimated by analysts. Its Q4 gross transaction value (GTV) stood at $33,461 million, up 10% year-over-year.

“We ended the year with Q4 orders and GTV growth at 11% and 10% year-over-year, respectively, and continued to have the leading share of sales by far in both small and big baskets amongst digital-first players,” said Instacart CEO Fidji Simo.

“Combined with our strong operating fundamentals, this helped us significantly expand profitability year-over-year, all while investing in new growth initiatives like Restaurants and Caper Carts, which have the ability to further compound our growth for many years to come.”

For Q1, Instacart projects GTV between $9 billion and $9.15 billion, with adjusted earnings before interest, taxes, depreciation and amortization between $220 million and $230 million, showing strong growth with potential moderation.

“This GTV outlook represents year-over-year growth between 8% to 10%, reflecting our strong start to the year,” the company said in its shareholder letter.

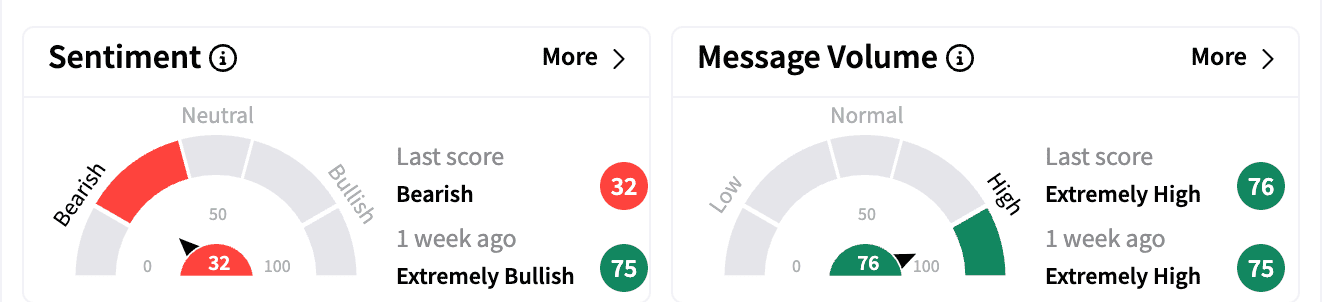

Sentiment on Stocktwits turned ‘bearish’ from ‘extremely bullish’ a week ago. Message volume moved up to the ‘extremely high’ zone.

One bearish commenter was concerned about the costs of food shopping going up.

Instacart is a grocery services provider that partners with grocers and retailers for online shopping, delivery and pickup services from nearly 100,000 stores.

Instacart stock is up 17.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)