Advertisement|Remove ads.

Integral Ad Science To Go Private In $1.9B Buyout Deal With Novacap

Integral Ad Science Inc. (IAS) announced on Wednesday that it is set to go private following a buyout deal with private equity firm Novacap. The all-cash acquisition values IAS at approximately $1.9 billion, marking a move to fuel its ongoing investment in AI-driven solutions.

Under the terms of the agreement, Novacap will acquire all outstanding IAS shares at $10.30 apiece, offering a 22% premium over the company’s closing price on Sept. 23, 2025.

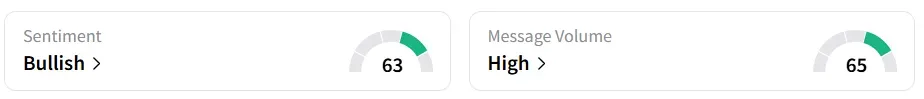

Following the announcement, Integral Ad Science's stock traded over 20% higher on Wednesday after the morning bell. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ territory from ‘bearish’ the previous day. Message volume improved to ‘high’ from ‘normal’ levels in 24 hours.

Vista Equity Partners, which currently holds a stake in IAS, will exit its position upon the transaction's closure. The deal has already secured approval from IAS’s board and a majority of its shareholders through written consent.

“As a private company with the support of Novacap, we will have access to new resources to achieve our strategic goals and further build upon the differentiated value we bring our customers as we advance our mission to be the global benchmark for trust and transparency in digital media quality," said IAS CEO Lisa Utzschneider.

The transaction is expected to close before the end of 2025. After the deal is finalized, IAS will continue operating under its existing name and leadership, but will no longer trade on public exchanges.

Integral Ad Science stock has shed over 2% year-to-date and 8% in the last 12 months.

Also See: Circus Deploys Meta's Llama AI In Defense Robots

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)