Advertisement|Remove ads.

Pre-Market Movers: Intel, Amazon, Apple Most Active Dow Jones Stocks — What’s Retail Thinking?

U.S. stock futures rose early Monday, buoyed by Friday's strong finish after Federal Reserve Chair Jerome Powell indicated it is time for a policy adjustment. Investors are now speculating on the quantum of the rate cut. Here's a look at the top three most active Dow Jones stocks pre-market, along with analyst and retail investor sentiment:

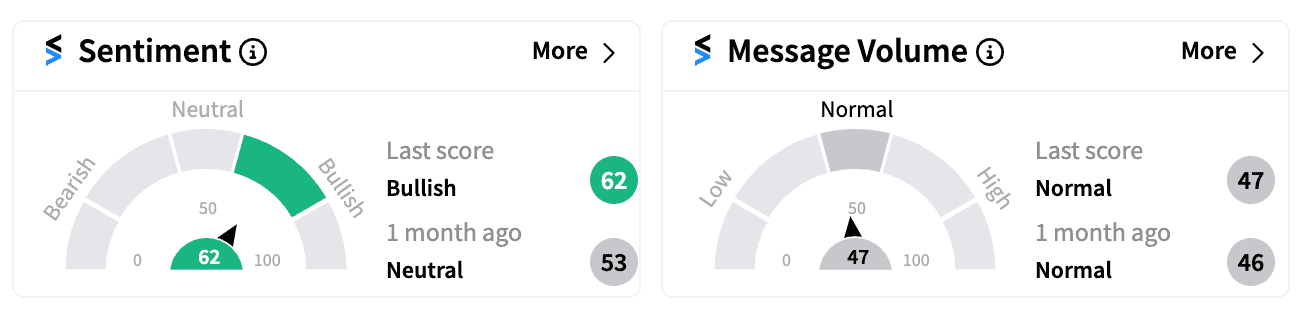

Intel Corp. (INTC): The beleaguered chipmaker’s stock rose pre-market after Friday's 2% gain. Stocktwits sentiment improved to ‘bullish’ (62/100) from ‘extremely bearish’ at the start of the month, when it reported underwhelming quarterly results.

While a Goldman Sachs analyst has reportedly said its $10 billion cost-cutting plan (including 15% headcount reduction) won’t be enough to give a competitive edge, the stock trading at 2015 levels seems to be attracting bargain hunters.

Intel is working with advisors to counter potential activist investors, according to CNBC. The company also recently learned of an unsolicited "mini-tender offer" by Tutanota LLC to Intel stockholders for one million shares at $34 each, contingent on the stock price exceeding that value by Sept. 4.

This month, Intel sold its entire Arm Holdings stake, potentially raising $147 million. INTC is down over 57% year-to-date.

Amazon.com Inc. (AMZN): The e-commerce giant faced selling pressure pre-market, despite Friday's gains. Wells Fargo lowered its price target to $225 (from $232) while maintaining an ‘Overweight’ rating after analyzing Amazon's Kuiper satellite internet project.

The analyst predicts high upfront launch costs (estimated $11 billion for 3,236 satellites by 2029) will reduce operating income forecasts from 2025 to 2027. While Kuiper holds long-term potential, its synergy with core operations remains unclear.

Amazon Web Services (AWS) also announced a $6.2 billion investment in Malaysia by 2038. Additionally, CEO Andy Jassy reported the company’s AI assistant generated $260 million in annual efficiency gains, saving “4,500 developer-years” of work.

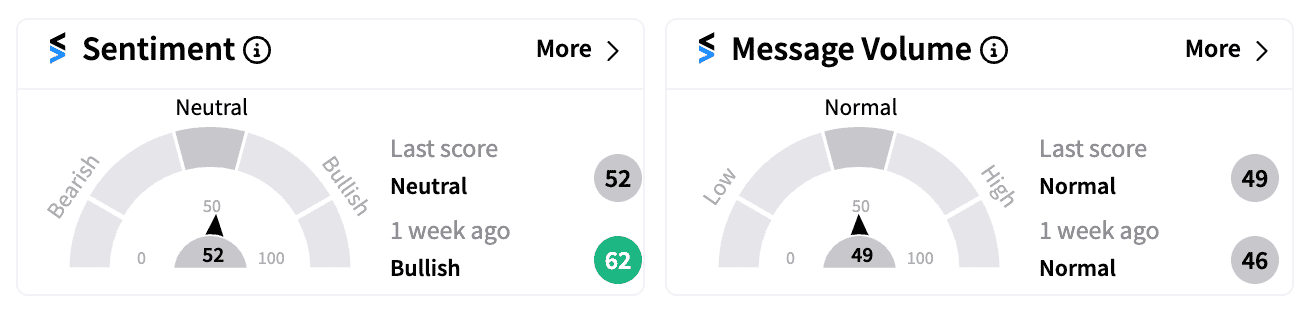

Stocktwits sentiment for AMZN dropped to ‘neutral’ (52/100) from ‘bullish’ last week. The stock remains up over 18% year-to-date.

Apple Inc. (AAPL): Apple shares fell pre-market after Friday's gains.

The company is reportedly exploring robotics with a potential tabletop device by 2026, combining an iPad-like display with robotic features. This could pave the way for advanced robotics in the future.

However, reports also suggest a delay in the mass production of its highly anticipated folding MacBook.

The next major catalyst is the upcoming iPhone launch on Sept. 10.

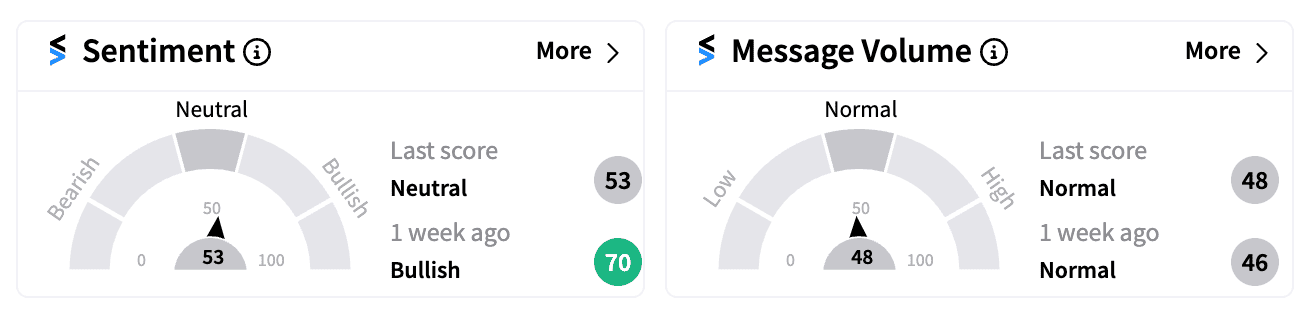

Retail sentiment on Stocktwits dipped to ‘neutral’ (53/100) from ‘bullish’ last week, with message volume remaining normal.

AAPL remains up over 22% year-to-date.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/gold-2025-10-4d60669f0f3918bea647540cac918715.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/07/coal-india-limited-cash-2024-07-05919a650f2f7cd60227a6c5870f49a6.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/Delhi-High-Court.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/06/rains-1-2025-06-060708f3c654431079b8b8ed32f46cf9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215606078_jpg_8fd67fede2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)