Advertisement|Remove ads.

Trump Sons Participate In QLE Convertible Note Sale: ASP Isotope Stock Surges 16%

- The offering was led by ASPI and American Ventures LLC, an investment firm with ties to Dominari Holdings, which is advised by Eric and Donald Jr.

- QLE intends to use the net proceeds from the offering to build and develop laser enrichment production facilities.

- The company stated that the notes will be unsecured and may be convertible into common equity securities of QLE before maturity, as well as upon the occurrence of certain specified events.

Shares of ASP Isotopes surged 16% on Friday after its unit Quantum Leap Energy (QLE) announced a $64.3 million private placement of convertible notes to investors, including U.S. President Donald Trump’s sons, Eric Trump and Donald Trump Jr.

The offering was led by ASPI and American Ventures LLC, with initial closing expected on or about November 10, the company stated.

American Ventures is an investment firm with ties to Dominari Holdings Inc., a boutique bank located in Trump Tower. Eric and Donald Jr. advise and invest in Dominari, according to a Bloomberg report.

The deal adds to a growing list of high-profile investments tied to Donald Trump’s family. Trump Jr.’s firm, 1789 Capital, has previously invested in rare earth magnet maker Vulcan Elements and aerospace manufacturer Hadrian.

Deal Details

The company stated that the notes will be unsecured and may be convertible into common equity securities of QLE before maturity, as well as upon the occurrence of certain specified events.

These include an initial public offering, direct listing, or future equity financing. In each case, the conversion will occur at a price per share equal to the lower of 80% of the per-share price in the applicable transaction or the per-share value of one share of QLE’s common equity, based on a set valuation cap.

Quantum Leap Energy, an advanced materials firm developing isotope production technologies, intends to use the net proceeds from the offering to build and develop laser enrichment production facilities.

How Did Stocktwits Users React?

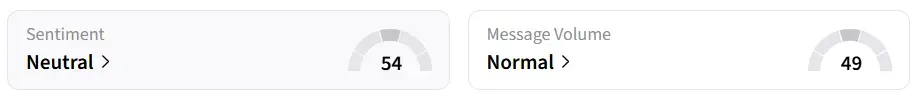

Retail sentiment on Stocktwits around the ASP Isotopes ticker turned ‘neutral’ from ‘bearish’ a day earlier. It was also among the trending tickers on the platform.

One user was bullish about the company’s fundamentals.

Year-to-date, ASPI stock has gained by 87%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)