Advertisement|Remove ads.

Intel Draws Mixed Street Reaction After Strong Q4 But Cautious 2026 Outlook

- Northland Securities noted the company’s strategic importance to the U.S. and called the guidance “very likely to be conservative.”

- Stifel described Intel’s Q4 results as a “robust beat,” but emphasized that Q1 projections reflect temporary inventory shortages.

- Bank of America suggested that Intel’s current stock price exceeds its near-term ability to execute a profitable business model.

Intel Corp. (INTC) stock continued to be in the spotlight on Friday after multiple analysts adjusted their price targets following the company’s fourth-quarter (Q4) earnings and cautious guidance for the first quarter (Q1) of 2026.

Despite reporting stronger-than-expected earnings per share in Q4, Intel’s forecast for Q1 fell short of analysts’ predictions. The company expects revenue between $11.7 billion and $12.7 billion, with the lower end notably below the $12.5 billion analysts’ consensus estimate, according to Fiscal.ai.

Street Opinion

Northland Securities raised its price target on Intel to $54 from $46 while maintaining an ‘Outperform’ rating, noting the company’s strategic importance to the U.S. and calling the guidance “very likely to be conservative,” according to TheFly.

Meanwhile, UBS raised its target to $52 from $49, with a ‘Neutral’ rating, citing supply bottlenecks and structural limitations that may constrain Intel’s AI growth potential.

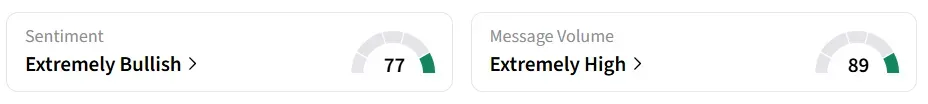

Intel stock traded 16% lower on Friday morning and was the top-trending equity ticker on Stocktwits. Retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

Stifel Sees Long-Term Prospects Improving

Stifel also adjusted its forecast, increasing the target to $42 from $35 while keeping a ‘Hold’ rating. The firm described Intel’s Q4 results as a “robust beat,” but emphasized that Q1 projections reflect temporary inventory shortages and high demand for server CPUs. Stifel expects Q1 to represent a fundamental low point, with longer-term prospects improving as production scales up.

Meanwhile, Bank of America reaffirmed an ‘Underperform’ rating with a $40 price target, suggesting Intel’s current stock price exceeds its near-term ability to execute a profitable business model.

In the Q4 earnings call, Intel CEO Lip-Bu Tan told that the rapid growth and broader adoption of AI tasks are putting heavy pressure on both existing and new hardware systems, highlighting how important CPUs have become in supporting AI technology.

According to a CNBC report, Jefferies said that though it recognizes the recent optimism around Intel’s potential, the firm still doesn’t see a clear direction ahead as the company lacks a defined AI plan, and faces uncertainty around its manufacturing and packaging business.

INTC stock has gained over 117% in the last 12 months.

Also See: Super Micro Stock Gains Momentum As Q2 Earnings Date Sparks Investor Interest

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AI_chip_representative_image_jpg_ab73461e0d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_home_depot_resized_jpg_41f1dc8f5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260490321_1_jpg_e83ecbf5cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)