Advertisement|Remove ads.

Intel’s Manufacturing Push Faces Fresh Test After Nvidia Passes On 18A Chips: Report

- Intel claims that its 18A process offers up to 15% better performance per watt and 30% better chip density.

- Nvidia’s hesitation came despite a $5 billion investment it made in Intel earlier this year.

- U.S. government took 10% equity stake in Intel in exchange for billions in funding.

Intel Corp. (INTC) continues to strike high-profile partnerships as it tries to revive its position in the global semiconductor race, even as questions linger over its ability to consistently manufacture advanced chips internally.

According to a Reuters report, Nvidia Corp.(NVDA) recently evaluated whether Intel’s 18A manufacturing process could be used to produce its own chips. After initial testing, Nvidia chose not to move ahead with production using that technology.

Intel claims that its 18A process offers up to 15% better performance per watt and 30% better chip density.

Manufacturing Questions Persist

Intel’s progress on deals contrasts with ongoing challenges inside its fabrication operations. The company’s foundry business has faced scrutiny as it works to prove that its newest processes can deliver reliable, high-quality output.

In July, the company stated in a Securities and Exchange Commission filing that it might suspend or abandon its foundry operations entirely if it fails to secure a significant client for its next-generation chips.

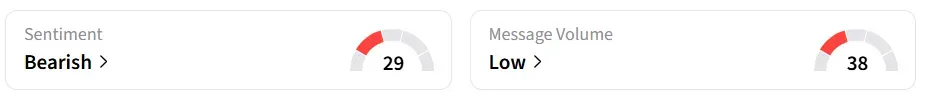

Intel stock traded over 3% lower in Wednesday’s premarket and was the most-trending equity ticker on Stocktwits. Retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Deals And Industry Stakes

Nvidia’s hesitation came despite a $5 billion investment it made in Intel earlier this year, which fell short of a manufacturing commitment. The partnership reflects a broader push by Intel to attract high-profile collaborators as it competes with overseas rivals such as Taiwan Semiconductor Manufacturing Co. (TSM).

Intel CEO Lip-Bu Tan, who took the role in March, faced political headwinds, but his meeting with President Donald Trump led to a landmark agreement that gave the U.S. government a nearly 10% equity stake in Intel in exchange for billions in funding.

Winning a major customer now would be a significant endorsement of Intel’s manufacturing revival. In November, TF International Securities analyst Ming-Chi Kuo said Intel is expected to ship Apple’s (AAPL) lowest-end M processor by the second or third quarter of 2027.

INTC stock has gained 81% year-to-date.

Also See: UiPath Gains Spotlight With Key Index Inclusion: Retail Believes ‘It Will Be Next Palantir’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)