Advertisement|Remove ads.

JB Pharma Slips As Market Prices In Open Offer Discount, Torrent Gains On Edge: SEBI RA Sanyam Vaish

India’s pharmaceuticals sector just witnessed its second-largest deal ever. Torrent Pharmaceuticals is set to acquire a controlling 49.18% stake in JB Chemicals & Pharmaceuticals in a blockbuster transaction worth ₹25,689 crore (~$3.1 billion).

JB Chemical shares fell over 6% while Torrent Pharma shares gained 2% on Monday.

SEBI-registered analyst Sanyam Vaish observed that JB Pharma slipped as investors priced in the 9% discount on the open offer, while Torrent rose on the deal positives and aggressive consolidation.

The Big Pharma Deal

Torrent will buy 46.39% from KKR and up to 2.8% from JB Pharma’s employee trust — all at ₹1,600/share. An open offer will follow, with Torrent launching a mandatory open offer for an additional 26% at ₹1,639.18 per share, valuing the open offer at nearly ₹6,843 crore.

Torrent Pharma will acquire JB Pharma through a share swap deal where 100 JB Pharma shares will be exchanged for 51 Torrent Pharma shares.

Vaish analysed the deal in detail and why it mattered.

1.Strategic Shift

He noted that JB Pharma brings a robust chronic therapies portfolio, strong prescription base, and a growing CDMO vertical. Torrent gains a ready platform to scale chronic and specialty businesses — both domestic and international.

2.Industry Impact

This deal makes Torrent Pharma India’s 2nd most valued pharma company after Sun Pharma. Combined revenues will stand at over ₹15,000 crore.

3. Market Power

Torrent gets access to more than 40 brands ranked in the top 300, along with JB's international operations in the US, South Africa, and select emerging markets.

As global players double down on India, M&A activity is on the rise. Scale, branded generics, and CDMO are the new battlegrounds, he added.

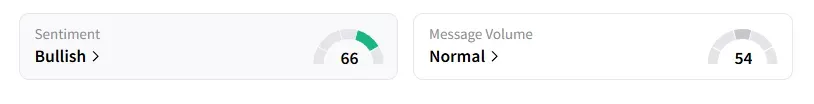

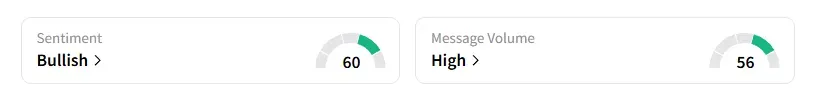

Data on Stocktwits shows that retail sentiment is ‘bullish’ on both these counters.

Torrent Pharma shares have risen 2% year-to-date (YTD), while JB Pharma shares have fallen 8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)