Advertisement|Remove ads.

JetBlue Airways Jumps 20% After Surprise Quarterly Profit: Retail Couldn’t Agree More

Shares of JetBlue Airways Corporation jumped nearly 20% after it reported a quarterly profit of $25 million or earnings per share of $0.08 against a Street estimate of a loss of $0.10. Investors also cheered the airline’s decision to defer nearly $3 billion in capital expenditure through 2029 to improve its cash flow outlook.

Although operating revenue fell 6.90% year-over-year (YoY) to $2.43 billion, it came mostly in line with analyst estimates. Investors also shrugged-off the fact that net income fell nearly 82% YoY.

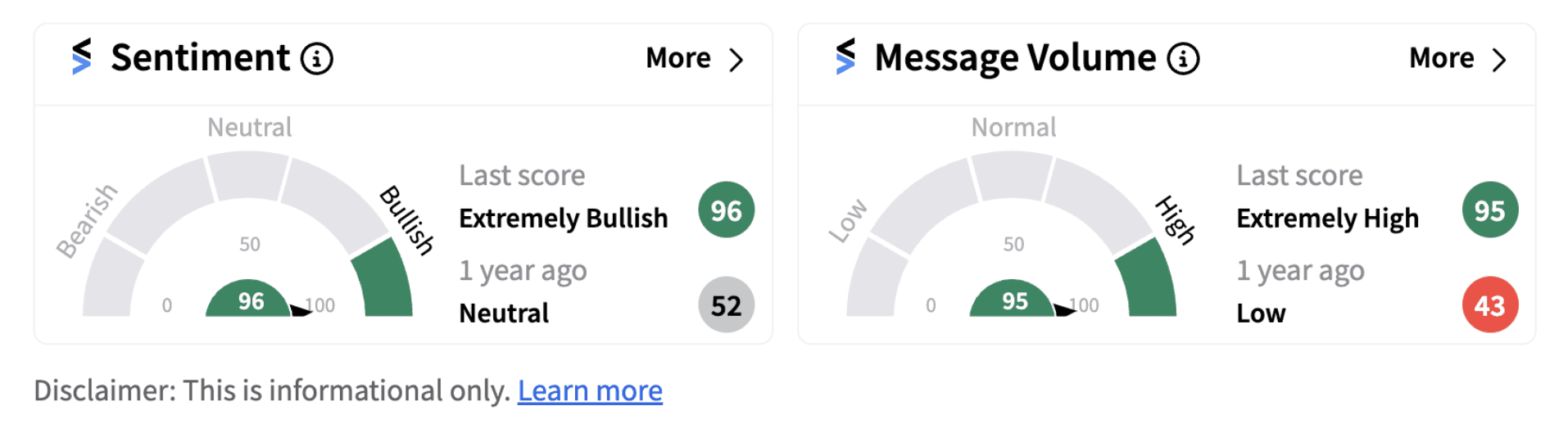

Following the earnings announcement and the jump in stock price, retail investor sentiment shifted from the bullish zone to the extremely bullish territory (96/100) to hit a one-year high, supported by huge message volumes.

The firm is implementing a strategy titled JetForward that intends to return the airline to sustained profitability. According to JetBlue CEO Joanna Geraghty the strategy involves four priority moves that include boosting reliability and doubling down on the firm’s commitment to caring service in order to improve satisfaction and drive cost savings.

Those priority moves target $800 million - $900 million in incremental earnings before interest and tax (EBIT) between 2025 to 2027. The management said the airline is reinvesting in its core geographies in New York, New England, Florida and Puerto Rico, while exiting routes and BlueCities that don't meet its financial hurdle rate.

Additionally, it will reinvest in building the best leisure network on the East Coast to enhance its existing product offering and loyalty perks.

In its outlook, the airline said it intends to cut available seat miles by up to 6% for the third quarter and up to 5% for the full year. Investors on Stocktwits are expressing optimism on the stock. One user named Nt714 asserted confidence in the direction taken by the CEO.

Photo Courtesy: Marko Pavlichencko on Unsplash

/filters:format(webp)https://news.stocktwits-cdn.com/large_Gold_Silver_jpg_c77de4fb71.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019667_jpg_24c888d76a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_6d16fbaa7e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jensen_Huang_jpg_0ccfe634b0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)