Advertisement|Remove ads.

JetBlue Stock Soars On BofA Upgrade, Price-Target Boost: Retail Unconvinced

Shares of JetBlue Airways Corporation (JBLU) jumped over 8% on Monday after Bank of America (BofA) reportedly doubled its price target on the stock to $6 while upgrading its rating to ‘Neutral’ from ‘Underperform.’

The analyst reportedly noted that as travel demand measured by TSA throughput has been stable in recent weeks and domestic capacity continues to moderate, coinciding with falling fuel prices, JetBlue's positioning will be further supported by self-help measures.

The brokerage cited high net leverage as the primary risk for the airline but also acknowledged its improving fundamentals and the supportive industry environment.

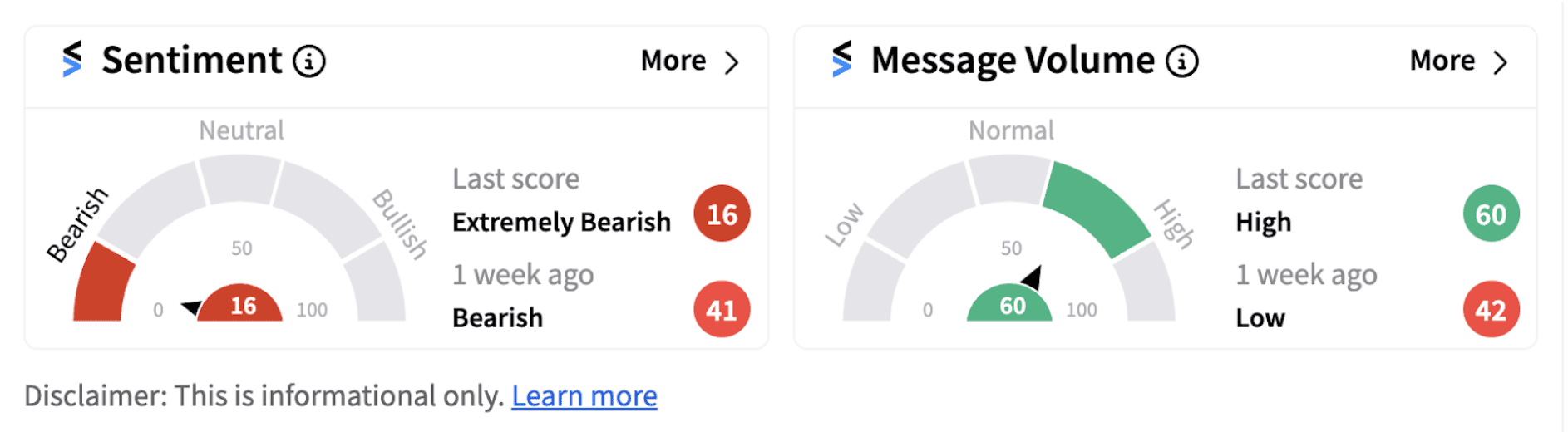

However, retail sentiment on Stocktwits dipped into ‘extremely bearish’ territory (16/100) from the ‘bearish’ zone a day ago. The move was accompanied by ‘high’ message volumes.

In August, ratings agencies S&P and Moody's reportedly downgraded JetBlue Airways after the carrier disclosed plans to raise more than $3 billion in debt, majority backed by its loyalty program, TrueBlue. Shares of the airline have lost nearly 5% in the last month.

Despite the negative news, it is notable that the firm reported a surprise profit during the second quarter. It posted an 82% year-over-year (YoY) decline in its net income to $25 million, but the figure beat Wall Street expectations of a loss. Moreover, the company’s announcement about deferring approximately $3 billion of capital expenditures through 2029, to improve its cash flow outlook, also found favor among investors.

JetBlue now expects to generate $800 - $900 million of incremental earnings before interest and taxes (EBIT) from 2025 through 2027 and expects the benefit to be realized evenly over those three years.

On a year-to-date (YTD) basis, the stock has gained over 9%. However, it is still down over 66% over the last five years. Investors will be watching out whether the airline manages to improve its financials in the coming quarters on the back of the revamp measures it announced.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)