Advertisement|Remove ads.

JM Financial, Bajaj Finance: SEBI RA Palak Jain Eyes Fresh Highs As Technicals Flash Green

Two financial stocks are flashing green on the charts. SEBI-registered analyst Palak Jain is bullish on JM Financial and Bajaj Finance, driven by strong technical indicators. She anticipates a breakout in both these counters.

Let’s take a look at the rationale behind her recommendations:

JM Financial

Jain noted that JM Financial’s share price has shown a significant increase from May to July. The stock is currently consolidating between support at ₹150 and resistance at ₹180 levels, with a good volume buildu, indicating the potential for a breakout.

The Directional Movement Index (DMI) also suggests a strong trend. Jain believes that the stock is likely to break out above the resistance level, making it a potential buy.

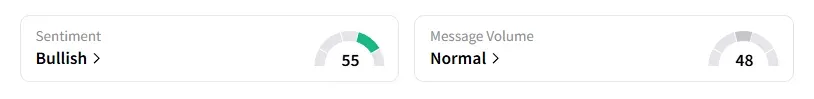

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago.

JM Financial shares have risen 39% year-to-date (YTD).

Bajaj Finance

Jain observed that Bajaj Finance is forming an ascending triangle pattern, a bullish technical indicator signaling a potential breakout. Additionally, its support level is rising, which shows increasing demand and a potential for the stock to move higher.

She added that a breakout above the resistance level (around ₹970) can lead to a significant price movement.

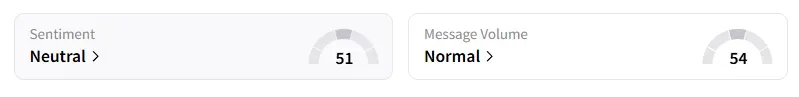

Data on Stocktwits shows that retail sentiment moved from ‘bearish’ to ‘neutral’ a day ago.

Bajaj Finance shares have risen 41% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_CME_Group_8b0ca24197.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1764993793_jpg_77bd68b18e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_elonmusk_OG_jpg_0752af8e37.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_old_White_House_c2cba4ca94.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Space_X_Elon_Musk_jpg_b27208e213.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)