Advertisement|Remove ads.

JPMorgan Adds Best Buy, Wayfair To Positive Catalyst Watch

JPMorgan has added big-box retailer Best Buy (BBY) and online home furnishing store Wayfair (W) to its Positive Catalyst Watch list, citing the less-than-feared impact of tariffs, improving fundamentals, and share levels that offer an attractive entry point.

According to Investing.com, JPMorgan said in a note, "the combination of attractive valuation/levels and improving sales trends to spark investor interest into the back-to-school and earnings season."

JPMorgan's Positive Catalyst Watch highlights stocks it expects to rise in the near term, driven by upcoming favorable events.

Best Buy sees favorable trends from the upcoming sale of the Nintendo Switch 2, as well as from students shopping for computers and tablets ahead of the school reopenings following the summer break.

The analyst said the stock is "highly worth the risk-reward at this price." Although Best Buy stock has recouped some losses in recent months, it is still down 20% year-to-date.

On Wayfair, JPMorgan indicated that the firm faces lower risk from tariffs because of its marketplace business model. It expects gross margins to recover in the back half of the year, and

Last week, Wayfair shares received a boost after media reports indicated that furniture retailer At Home is nearing bankruptcy.

Following those, Mizuho said Wayfair is best positioned within its coverage to pick up any displaced revenues from an At Home bankruptcy.

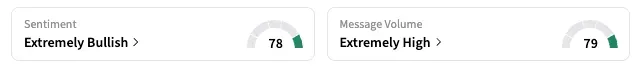

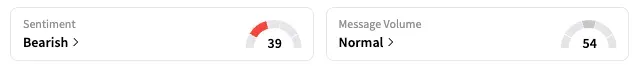

On Stocktwits, the retail sentiment was 'extremely bullish' for Best Buy, and 'bearish' for Wayfair.

In recent quarters, Best Buy faced revenue declines and reduced guidance due to the impact of tariffs, while Wayfair achieved modest growth, improved profitability, and exited the German market to streamline its operations.

Wayfair shares are down 6.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)