Advertisement|Remove ads.

JPMorgan Sees Near 50% Upside On This Chinese eVTOL Maker: Retail Believes There’s A Lot To Look Forward To

JPMorgan initiated coverage of electric vertical take-off and landing aircraft manufacturer EHang (EH) with an ‘Overweight’ rating and $26 price target. The price target implies an upside of about 49% from the stock’s closing price on Thursday.

The firm expects the global passenger electric vertical take-off and landing aircraft market to grow to $100 billion by 2040 and notes that EHang holds certificates in China that make it "uniquely positioned to scale from prototypes to a commercial model," as per TheFly.

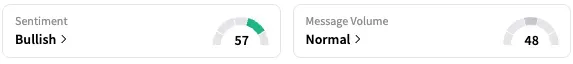

JPMorgan identifies EHang as China's "leading" eVTOL original equipment manufacturer and sees a clear path to breakeven ahead. On Stocktwits, retail sentiment around EHang rose from ‘bearish’ to ‘bullish’ territory over the past 24 hours, while message volume rose from ‘low’ to ‘normal’ levels. Shares of the company jumped 4% in the pre-market session at the time of writing.

A Stocktwits user opined that there is a lot to look forward to with the stock.

“EHang is positioned to capture an outsized share of early eVTOL volumes in China. Most peers remain 1-4 years behind in commercial readiness, while EHang is scaling toward 300-800 units annually in 2025-27E and building unmatched operator experience — laying the foundation for global leadership in the first wave of eVTOL adoption,” the firm stated, as reported by CNBC. “Multi-Product Portfolio aligned to monetize both near-term (sightseeing, public services) demand in China and long-term (cargo, intercity transport) demand globally.”

JPMorgan remains optimistic on the long-term growth story for the stock, given the current order backlog of over 1000 units. The firm expects the company’s net profit to grow at a compound annual rate of 307% between fiscal years 2025 and 2027, CNBC reported.

EH stock is up by 11% this year and by about 20% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)