Advertisement|Remove ads.

Karur Vysya Bank Extends Rally: SEBI Analyst Signals Strength Above ₹224

Karur Vysya Bank has been in a steady uptrend, with its shares clocking 3% gains on Wednesday, adding to the 10% rally over the past month.

The South Indian private lender reported robust performance in its quarterly business update last week. It has seen a significant year-over-year growth of 15.37% in its total business, which reached ₹2,03,211 crore.

Both deposits and credit growth were strong. Karur Vysya Bank's total deposits witnessed a healthy increase of 15.29% YoY, and credit growth rose by 15.47%.

It was among the top trending stocks on Stocktwits, at the time of writing.

Technical Outlook

SEBI-registered analyst Sunil Kotak noted that on its weekly charts, the Relative Strength Index (RSI) was above 60, indicating a bullish sentiment. Additionally, its RSI on the daily as well as monthly charts trended above 60.

He believed that a close above ₹223-₹224 shall be very positive for Karur Vysya Bank shares. The overall bias on the banking sector also remained positive.

News Developments

Recently, the private lender had filed writ petitions before the Madurai Bench of the Madras High Court challenging reassessment proceedings initiated by the Income Tax Department. The matter is unlikely to have any material impact on its financial position or operations, the bank stated.

What Is The Retail Mood?

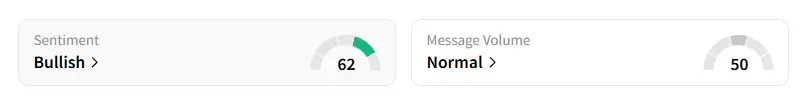

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Karur Vysya Bank shares have risen 25% year-to-date (YTD)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)