Advertisement|Remove ads.

KB Home Stock Surges In After-Hours On Q4 Earnings Beat: Retail Cheers

Shares of KB Home ($KBH) were up nearly 11% in after-hours trading on Monday after the company reported better-than-expected fourth-quarter earnings, lifting retail sentiment.

The company’s revenues rose 19% year-over-year to $2 billion, beating estimates of $1.99 billion.

Diluted earnings per share grew 36% to $2.52, beating consensus estimates of $2.44, driven by higher net incomes and favorable impact of the company’s common stock repurchases.

Its net income rose 27% to $190.6 million for the quarter. In the fourth quarter, the company repurchased about 1.3 million shares of its outstanding common stock at a cost of $100.0 million, bringing its total repurchases in 2024 to about 4.73 million shares at a cost of $350 million, or $74.07 per share. As of November 30, it had $700 million remaining under its current common stock repurchase authorization, the company said.

“We had a strong finish to 2024, with significant year-over-year growth in our fourth-quarter revenues and diluted earnings per share,” Jeffrey Mezger, chairman and CEO said. “Operationally, we executed well, opening 106 new communities, significantly reducing our build times and achieving the highest level of customer satisfaction in our company’s history."

Mezger added the company plans to remain focused on expanding scale and investments in 2025.

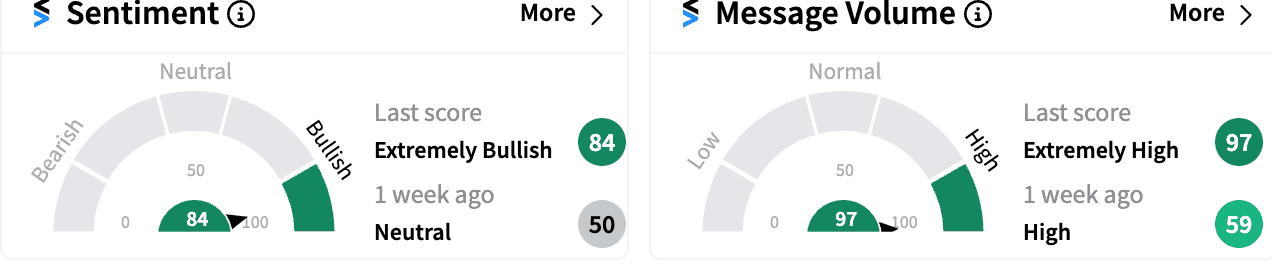

Sentiment on the stock jumped to ‘extremely bullish’ from ‘neutral’ a week ago. Message volumes have climbed into the ‘extremely high’ category.

For 2025, it expects housing revenues in the range of $7.00 billion to $7.50 billion, with the average selling price in the range of $488,000 to $498,000.

It expects homebuilding operating income as a percentage of revenues of about 10.7%; and housing gross profit margin in the range of 20.0% to 21.0%.

KBH stock is down 3.74% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)