Advertisement|Remove ads.

KEC International Shares: SEBI RA Sameer Pande Projects 15% Upside, Flags Support At ₹760–720

KEC International shares surged 3% on Tuesday as the street cheered its healthy fourth-quarter (Q4 FY25) earnings performance and robust orderbook.

The stock has been in an uptrend, rallying nearly 22% in the last month, driven by multiple order wins.

SEBI-registered analyst Sameer Pande observed that KEC displays strength in the technical charts, particularly in the monthly timeframe.

The Relative Strength Index (RSI) is positioned near 54, and a robust support zone is evident in the ₹760–720 range.

Pande suggests a stop loss on a closing basis for risk management at ₹790.

The upside target is set at ₹980, to be achieved by July-end.

On the earnings front, KEC International’s Q4 revenues rose 11% to ₹6,872 crores, while profits surged 77% to ₹268 crores.

Their FY25 order inflows rose 36% to ₹24,689 crore, and the cumulative order book as of March 2025 stood at ₹33,398 crore.

The board has also recommended a final dividend of ₹5.5 per share for FY25, subject to shareholder approval at the upcoming AGM.

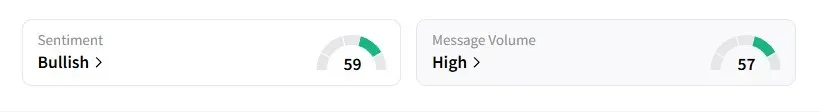

Data on Stocktwits shows retail sentiment turned ‘bullish’ from ‘bearish’ a week ago amid ‘high’ retail chatter.

KEC shares have fallen 26% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)