Advertisement|Remove ads.

Kohl’s Corp Stock Rises Ahead of Q4 Earnings: Retail’s Upbeat About Further Uptick

Shares of Kohl’s Corp have risen more than 8% in the past five days ahead of the retailer’s fiscal fourth-quarter earnings, with retail traders staying optimistic.

Wall Street analysts expect the company to post Q4 earnings per share (EPS) of $3.52 on revenue of $3.78 billion. The company missed EPS estimates twice out of the past four quarters.

Last week, Telsey Advisory analyst Dana Telsey lowered the price target on Kohl's to $13 from $17 with a ‘Market Perform’ rating, The Fly reported.

According to the firm, while the company’s mid-single digit decline in expenses and inventory decrease are all good indicators, the prevailing macroeconomic operating environment will need more time and fresh ideas, said the report.

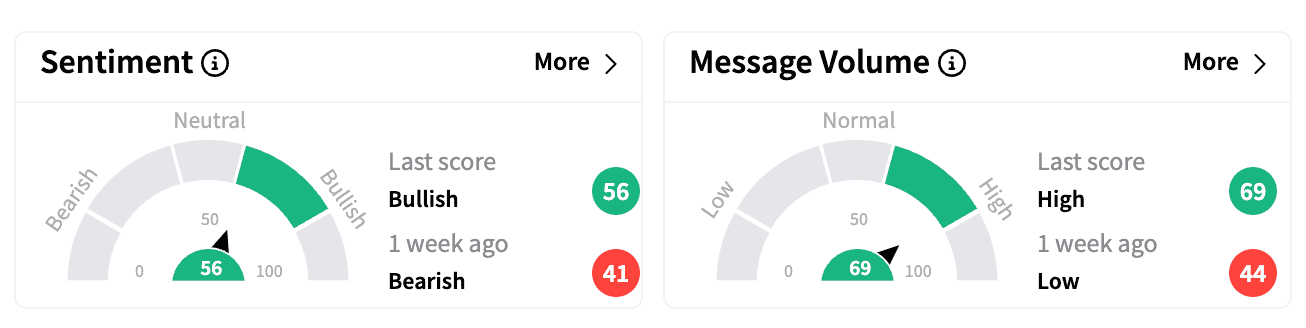

Sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week ago. Message volume climbed to ‘high’ from ‘low.’

One watcher was hopeful of a positive outlook from the company.

Another was watching for a 20% upside move in pre-market trading.

Kohl’s new CEO, Ashley Buchanan, joined the firm in January tasked with turning around the retailer’s business and attracting younger customers.

Last month, Kohl’s reportedly cut 10% of its corporate workforce to boost profitability. The news came shortly after the company also disclosed plans to close 27 of its “underperforming stores” in April.

Kohl’s third-quarter earnings missed Wall Street estimates with weak sales in apparel and footwear businesses. Its net sales decreased 8.8% and comparable sales decreased 9.3%.

Kohl’s stock is down 14% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)