Advertisement|Remove ads.

KPIT Tech Shares: Technicals Hint At Recovery Potential But It Needs To Break Above This Level, Says SEBI Analyst

Software company KPIT Technologies ended in the red on Thursday, tracking broader markets weakness after US President Donald Trump announced a 25% tariff, along with “penalties” for Indian goods.

Technical outlook

KPIT Technologies’ stock is showing early signs of a technical reversal after correcting more than 30% from its highs, said SEBI-registered analyst Rajneesh Sharma.

On the weekly chart, the stock is seeing a bullish relative strength index (RSI) divergence, a setup typical of reversing momentum even as price lags.

This is coupled with a breakout above a falling trendline, which indicates that there could be a selling exhaustion, the analyst said.

The ₹1,178 support zone has held firmly and acted as a rebound point this week. For confirmation, however, a decisive breakout above ₹1,420 remains critical, Sharma noted. If that fails, downside risk reopens toward ₹1,042.

Q1 Operations

KPIT Technologies reported a net profit of ₹172 crore for Q1FY26, marking a 16% decline, primarily due to the impact of currency fluctuation. However, revenue grew 12.7% to ₹1,539 crore, while EBITDA rose to ₹324 crore. Margins held steady at 21%.

Operational trends point to cautious recalibration, the analyst said.

Headcount saw a net decline of 169 employees, the first drop in years. While growth from top clients and demand in digital services held up, the slowdown hints at softer visibility.

On the positive side, KPIT secured $241 million in new deals, with strength in EV software, AI, and validation platforms. Its strategic tie-up with JSW Motors and continued focus on the “India-for-World” model are long-term positives, Sharma added.

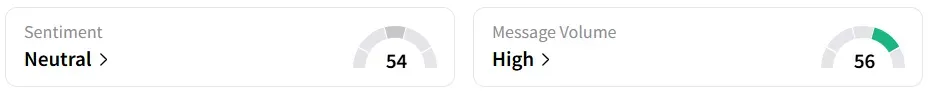

Retail sentiment on Stocktwits turned ‘neutral’ amid ‘high’ message volumes. It was ‘bullish’ a day earlier.

Investors will also keep an eye on the tariff impact on software services stocks.

Year-to-date, KPIT has shed over 16%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)