Advertisement|Remove ads.

LandBridge Stock Slips After Q4 Revenue Miss, Retail’s Still Bullish

LandBridge Co (LB) stock edged lower in extended trading on Wednesday after the company’s fourth-quarter revenue fell short of Wall Street’s estimates.

According to FinChat data, the company posted quarterly revenue of $36.5 million, compared with Wall Street’s estimated $38.3 million.

The company, which owns about 276,000 surface acres across the oil-heavy Delaware Basin, reported a net income of $8.2 million for the three months ended Dec. 31, compared to a profit of $2.5 million in the year-ago quarter.

The company’s fourth-quarter surface use royalties and revenue rose to $25.5 million, compared to $16.5 million in the previous quarter. The growth was driven by a non-refundable $8 million option payment received in December related to a data center lease development agreement and increased produced water royalty volumes.

Its oil and gas royalties revenue rose to $4.5 million in the fourth quarter, compared with $2.9 million in the third quarter, aided by higher net royalty production.

“For 2025, we anticipate another year of strong revenue growth and profitability as we execute on our active land management strategy,” Chief Financial Officer Scott McNeely said.

Landbridge reaffirmed its 2025 adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) forecast between $170 million and $190 million, backed by new acquisitions and higher royalties.

The company had completed a deal for 46,000 acres of land in the Delaware basin from a unit of VTX Energy Partners during the fourth quarter.

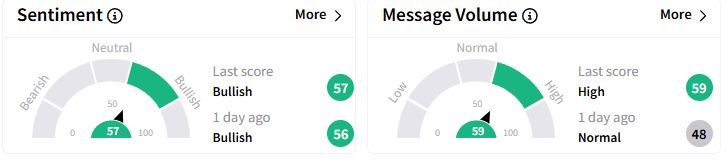

Retail sentiment on Stocktwits remained in the ‘bullish’ (57/100) territory, while retail chatter rose to ‘high.’

Over the past year, Landbridge stock has more than tripled.

Also See: Miller Industries Stock Slides After-Hours on Q4 Revenue Miss, Retail’s Still Upbeat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)