Advertisement|Remove ads.

Tata Motors Demerger Goes Live Tomorrow — Here’s What Retail Investors Need To Know

Tata Motors’ shares were down 1.7% in early trade on Monday, ahead of the demerger.

The demerger will officially take effect from Tuesday, October 14, as the company spins off its operations into two standalone entities, TML Commercial Vehicles (TMLCV) and Tata Motors Passenger Vehicles Ltd. (TMPVL).

Eligible shareholders of Tata Motors will be eligible to receive one share of the demerged entity for every one share they own. Shares currently carry a face value of ₹2 each.

Demerger Details

The demerger scheme separates the passenger and commercial vehicle businesses. The newly named Tata Motors Passenger Vehicles will retain the passenger vehicle, electric vehicle, and Jaguar Land Rover (JLR) businesses, while the demerged entity, TML Commercial Vehicles, will hold the commercial vehicle operations.

TML Commercial Vehicles Limited will be renamed as Tata Motors Limited, the company said in a statement on October 9.

NCD issue

Tata Motors will also transfer ₹2,300 crore worth of non-convertible debentures (NCDs) to TMLCV as part of the spin-off.

Brokerage Call

Brokerage sentiment remains mixed. According to reports, HDFC Securities has a ‘reduce’ rating with a target price of ₹706, expecting a sharp drop in consolidated earnings due to weaker JLR performance and margin pressure.

Investec holds a ‘neutral’ stance with a ₹765 target, projecting JLR revenue to decline 18% amid the recent cyberattack. Meanwhile, Kotak Securities foresees domestic CV volume growth picking up in H2FY26 and continued strength in PV bookings, which have surged 25% - 30%.

Stock Watch

Tata Motors’ stock has been in a downtrend lately, falling in the last seven sessions and declining around 7% during the period. The stock has gained in just one session so far in October.

It was the top laggard on the benchmark Nifty 50 index.

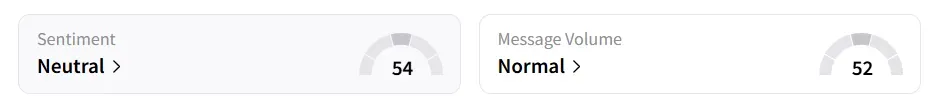

Retail sentiment on Stocktwits has remained ‘neutral’ for a while. It was ‘bullish’ a month back.

Year-to-date, the stock has declined 10.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)