Advertisement|Remove ads.

LendingTree Stock Soars After Q4 Profit Sails Past Expectations, Retail Mood Brightens

LendingTree (TREE) stock jumped 15.3% in extended trading on Wednesday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The online lending marketplace posted an adjusted net income of $15.8 million, or $1.16 per share for the three months ended Dec. 31, while analysts, on average, expected the company to post $0.53 per share, according to FinChat data.

Its quarterly revenue nearly doubled to $261.5 million and exceeded Wall Street’s expectations of $238.12 million.

The company reported a net income of $7.5 million, or $0.55 per share, compared with $12.7 million, or $0.98 per share in the year-ago quarter.

The company’s insurance segment revenue more than doubled to $171.7 million, as companies increased their marketing spend on LendingTree steadily throughout the year due to a rise in demand for new customers created by positive underwriting results.

LendingTree’s home segment revenue rose 35% to $34 million. The firm expects further growth in its home equity business this year as home valuations continue to hover near record levels.

The company said its personal loan revenue grew 21% to $26.5 million during the quarter as lenders increased their appetite for new loan originations after the stabilization of consumer credit performance, last year.

The Charlotte, North Carolina-based company forecasted 2025 revenue to be between $985 million and $1.03 billion. Wall Street expects it to post $1.02 billion in revenue.

LendingTree said it expects double-digit percentage points revenue growth in both the home and consumer segments, with more modest insurance segment growth following a record year.

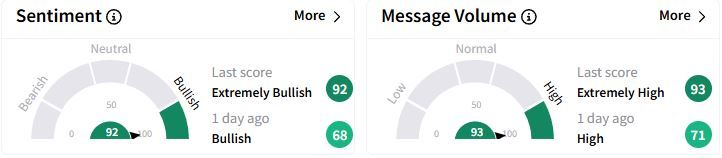

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (92/100) territory from ‘bullish’(68/100) a day ago, while retail chatter rose to ‘extremely high.’

One user hailed the earnings as a ‘blockbuster’ and expected the stock to trade between $60 and $100 soon.

Another retail trader expected to see more insider buying following the earnings report.

Over the past year, LendingTree shares have gained 3.8%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)