Advertisement|Remove ads.

Lucid Diagnostics Stock Sinks After-Hours On Equity Raise, But Retail Dives In Anyway

Lucid Diagnostics Inc. shares (LUCD) tumbled more than 21% in after-hours trading Wednesday after the medical diagnostics technology firm announced a capital raise via a public offering.

However, retail sentiment on Stocktwits remained firmly bullish, with many users viewing the pullback as a potential buying opportunity.

The company priced 12.5 million shares of its common stock at $1.20 apiece, below the last closing price of $1.65.

Canaccord Genuity is the sole bookrunner, and Maxim Group is the co-manager.

Lucid said the funds would be for working capital and general corporate purposes.

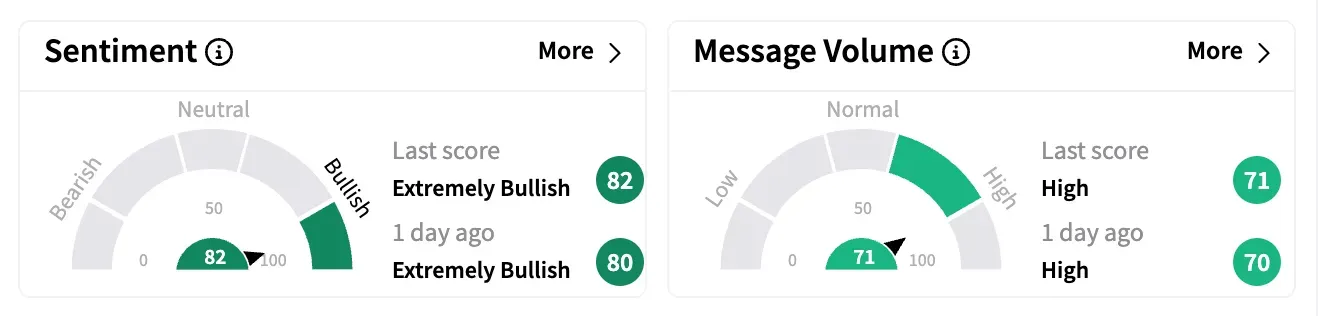

On Stocktwits, sentiment for the stock climbed higher within the 'extremely bullish' zone late Wednesday, while message volume rose by more than 18%.

One user hoped CEO Lishan Aklog would explain that the latest offering would help the company break even and make it "a lot more palatable."

Another optimistic watcher reshared a post from X that argued Lucid's offering demonstrates confidence that Medicare approval "is imminent."

Late in March, BTIG lowered its price target on Lucid stock to $2 from $2.50, citing dilution from a recent financing.

However, the research firm kept a 'Buy' rating on the stock after the company's "solid Q4 volume beat" and 79% revenue growth in 2024.

BTIG said Lucid addresses a significant unmet need with its minimally invasive EsoGuard for esophageal precancer testing.

During its recent earnings call, the company said it believes it is "on the cusp of achieving broader payor coverage for EsoGuard" to drive revenue growth in the second half of 2025.

Lucid Diagnostics stock has nearly doubled so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_japan_jpg_5a4a8c1f81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931078_jpg_7ccfff654b.webp)