Advertisement|Remove ads.

Lucid Motors ($LCID) Is Retail's Latest Rebound Bet

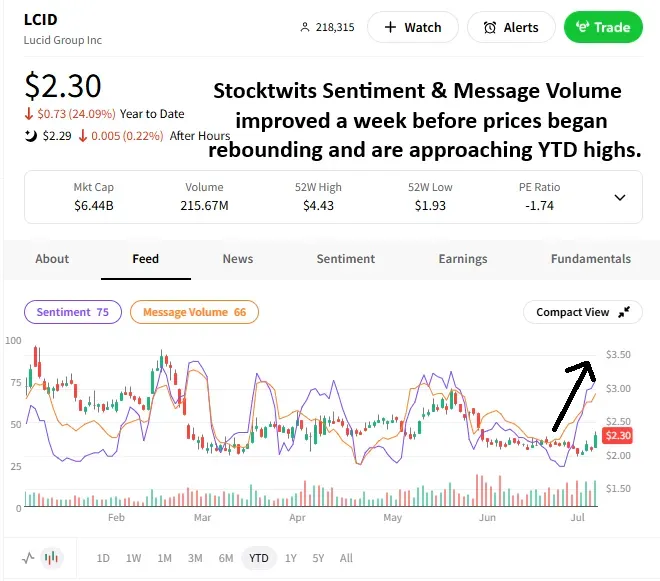

The electric vehicle maker’s shares recently probed all-time lows, but are making a turn to the upside this week. Stocktwits Sentiment and Message Volume turned positive ahead of this run and now suggests retail is looking for further upside.

As the chart below shows, Stocktwits Sentiment hit a fresh low in late June before reversing sharply to the upside to start July. Now, both metrics are approaching their YTD highs following the announcement that Lucid’s premium Grand Touring Air drove 1,205 km on a single charge, surpassing the previous world record by 160km. The elevated chatter and sentiment suggest retail is looking for further gains ahead.

From a technical perspective, many traders in the Stocktwits community are using the recent lows near 2.00 as a point of reference, looking for a move toward broken support/resistance and the 200-day moving average at 2.60.

Although the stock remains in a long-term downtrend, traders on StockTwits are looking to capitalize on this renewed momentum. Any weakness back toward 2.00 is viewed as a buying opportunity, while heavier selling is expected near 2.60.

Add $LCID to your watchlist to monitor this development. More importantly, to source these sentiment insights yourself, subscribe to Stocktwits Edge to unlock all the historical sentiment data for equities and crypto.

Unlock Stocktwits Sentiment insights with Stocktwits Edge — subscribe now.

*This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in Lucid Motors as of the time of publishing. For any questions or comments, please email tbruni[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)