Advertisement|Remove ads.

Lucid, Rivian Retail Traders Cheer Q1 Print Despite EV Makers Flagging Trump Tariff Turbulence

Lucid Group, Inc. (LCID) and Rivian Automotive, Inc. (RIVN) reported better-than-expected quarterly financial results after the market closed on Tuesday but warned of pressure from U.S. automotive tariffs.

Retail traders were pleased with the overall print even as the stocks diverged in after-hours trading.

Lucid, backed by Saudi Arabia's sovereign fund, reported first-quarter revenue of $235 million, below the consensus estimate of $246.16 million. However, an adjusted loss of $0.20 per share was better than a feared $0.23.

The company said it produced 2,212 vehicles in Q1, not including over 600 vehicles in transit to Saudi Arabia for factory gating. Deliveries for the quarter rose over 58% year-over-year to 3,109.

Meanwhile, Irvine, California-based Rivian topped estimates on both key metrics — an adjusted loss of $0.48 per share on revenue of $1.24 billion. Wall Street expected a much wider loss of $0.92 per share on revenue of $1.02 billion.

The EV maker posted its second consecutive quarterly gross profit of $206 million, its highest to date. The company said it was making progress with its cheaper R2 model, and the ongoing expansion at its Illinois plant.

However, Rivian trimmed its 2025 delivery outlook to 40,000–46,000 units from a prior projection of 46,000-51,000, citing tariff-related headwinds and macroeconomic uncertainty.

The company raised its full-year capital expenditure guidance to $1.8 billion-$1.9 billion but reiterated its adjusted EBITDA loss forecast of $1.7 billion-$1.9 billion.

Rivian still expects to achieve a modest positive gross profit for 2025.

Lucid said it now expects a potential gross margin headwind of 8% to 15% due to tariffs, up from its earlier estimate of 7% to 12% during the fourth-quarter earnings call.

The company, however, maintained its 2025 production forecast of approximately 20,000 vehicles despite macro uncertainties. It ended the quarter with $5.76 billion in liquidity, which Lucid believes provides a runway into the second half of 2026, not including potential Saudi fund loans or government grants.

Lucid's stock gained nearly 1.3% in Tuesday's extended session, while Rivian's stock fell over 1.5%.

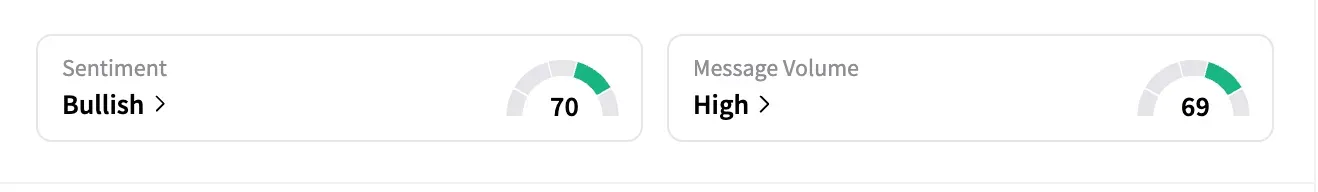

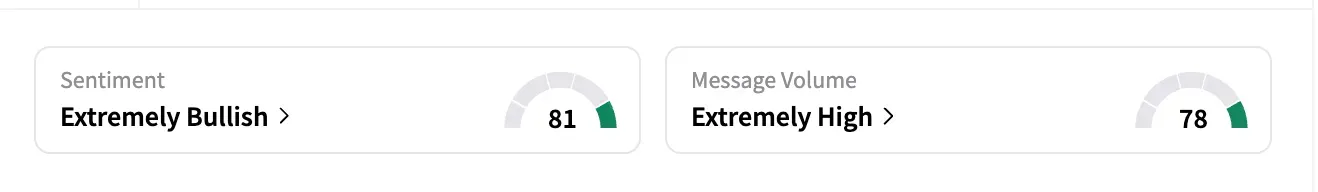

Stocktwits sentiment ended on bullish note for both tickers on Tuesday, while the message volume over the past 24 hours more than doubled.

"The results are better than expected compared to other big names. The future is bright regardless of those scammers/shorts," said one optimistic watcher on Lucid's stream.

Another user said they have "been bullish [on Lucid] ever since Tesla became hated by many; in my mind, this is the new Tesla."

One Rivian stream watcher said, "If we use Tesla logic, this stock should hit $1800 based on these earnings."

One retail trader pointed out that Rivian unlocked $1 billion in milestone payments from partner Volkswagen after reporting a second straight quarter of gross profit — part of their mega joint venture announced last year.

Lucid shares are down over 23% year to date, while Rivian is faring relatively better with a more than 1% gain.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)