Advertisement|Remove ads.

Magson Near Breakout Zone, Elgi Rubber In Technical Squeeze: SEBI RA Flags Key Levels To Watch

Magson Retail and Elgi Rubber are both approaching inflection points on the charts, indicating that a breakout may be imminent. SEBI-registered analyst Vijay Kumar Gupta has identified these two small-cap stocks, driven by technical indicators, but also advised caution before entering.

Magson Retail

Magson is trading within a narrowing range after a strong move from ₹100 to ₹145. The stock has tested the upper trendline and now seems to be settling near the mid-range. A breakout from here will define the next leg, either a continuation upward or a deeper pullback, according to Vijay Kumar Gupta.

In recent news, the company has expanded its distribution footprint and strengthened brand partnerships, driving revenue growth. However, consumer spending trends remain moderate, especially in rural and semi-urban areas, which may potentially limit near-term traction, he added. Management commentary suggests cautious optimism with a focus on margin control and cost discipline.

On the technical side, Gupta identified the upper resistance trendline between ₹143–₹145 (a zone that has resisted sharp gains). A breakout and close above ₹145 on volume would signal a bullish breakout.

On the downside, he sees immediate support at ₹131.5–₹132, which was a recent consolidation base. A decisive break below this level opens up downside to the next support at ₹129–₹130, which, if breached, could lead to testing the trendline support around ₹125.

Gupta noted that Magson’s primary trendline support stands at ₹115, which aligns with the longer-term rising trend. A significant break below ₹125–₹115 would threaten the structure. Price action shows a tightening range with mild bearish bias. Volumes have dipped post-rally, indicating a cooldown before the next move.

Gupta suggests that traders watch for a breakout above ₹145, accompanied by increased volume, and buy on a close above this level. If ₹132 breaks, watch for a drop to ₹129–₹130 for base support and a potential swing buy setup. A break under ₹129 could spark a pullback toward ₹125 or as low as ₹115; he recommended staying sidelined until stabilization.

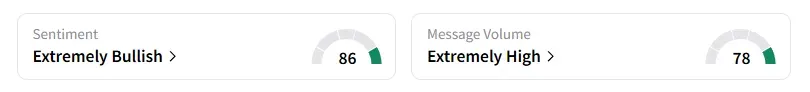

Data on Stocktwits shows that retail sentiment is ‘extremely bullish’ amid very high message volumes.

Magson shares have risen 37% year-to-date (YTD).

Elgi Rubber Company

Gupta noted that Elgi Rubber is consolidating just below its recent highs near ₹60 after a sharp multi-month rally. Despite improving topline, recent quarters have reflected margin stress. Structurally, the stock is in a technical squeeze zone, and a directional breakout is imminent.

On the fundamentals, its revenue continues to grow at a slow pace, but rising input costs and inefficiencies led to a reported net loss in the latest quarter. On a full-year basis, the company transitioned from profitability to a loss, indicating operational challenges in its core rubber and retreading businesses.

Valuations remain modest, and investor focus is shifting toward whether this is a cyclical bottom or a structural issue.

On the technicals, he identified immediate resistance at ₹62–₹63. This is the top of the recent range and marks a potential breakout level. A daily close above this level with volume could open the door toward ₹70–₹75.

Key support stands at ₹55, which has acted as a recent floor in the last consolidation. It’s also a technical pivot zone, and a reversal here could spark a swing rally. Secondary support is evident at ₹50, and this area could provide a lower-risk entry point for medium-term investors.

Indicators show consolidation with weakening short-term momentum. However, there's no sign of panic selling. The price is likely to remain rangebound unless volume confirms a breakout or breakdown.

Gupta highlighted that if Elgi holds ₹55 and forms a bullish reversal candle, one can initiate a short-term long targeting ₹62–₹63. If price breaks ₹63 with strong volume, he advises watching for targets around ₹70–₹75 over the medium term. On the other hand, if it breaks below ₹55, wait near ₹50 for a clean base to form before considering fresh entries.

He concluded that Elgi Rubber is a low-float stock and requires confirmation before high-conviction setups emerge.

Elgi Rubber shares have fallen 34% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)