Advertisement|Remove ads.

Mainz Biomed Vs. Aurinia Pharma: Retail Traders Weigh In On The Better Biotech Bet

Biotech stocks are a hot-button topic for retail investors on Stocktwits, where over four million users track these companies, hoping to spot the next big therapeutic breakthrough.

Two names currently trending in the space are Mainz Biomed, a molecular genetics cancer diagnostic company based in Germany, and Aurinia Pharmaceuticals Inc., a Canadian biopharmaceutical firm focused on autoimmune disease treatments.

Over the past three months, Mainz has seen a staggering 2,500% increase in message volume on Stocktwits, while Aurinia’s engagement has grown just 23%.

However, Aurinia maintains nearly three times the following of Mainz on the platform.

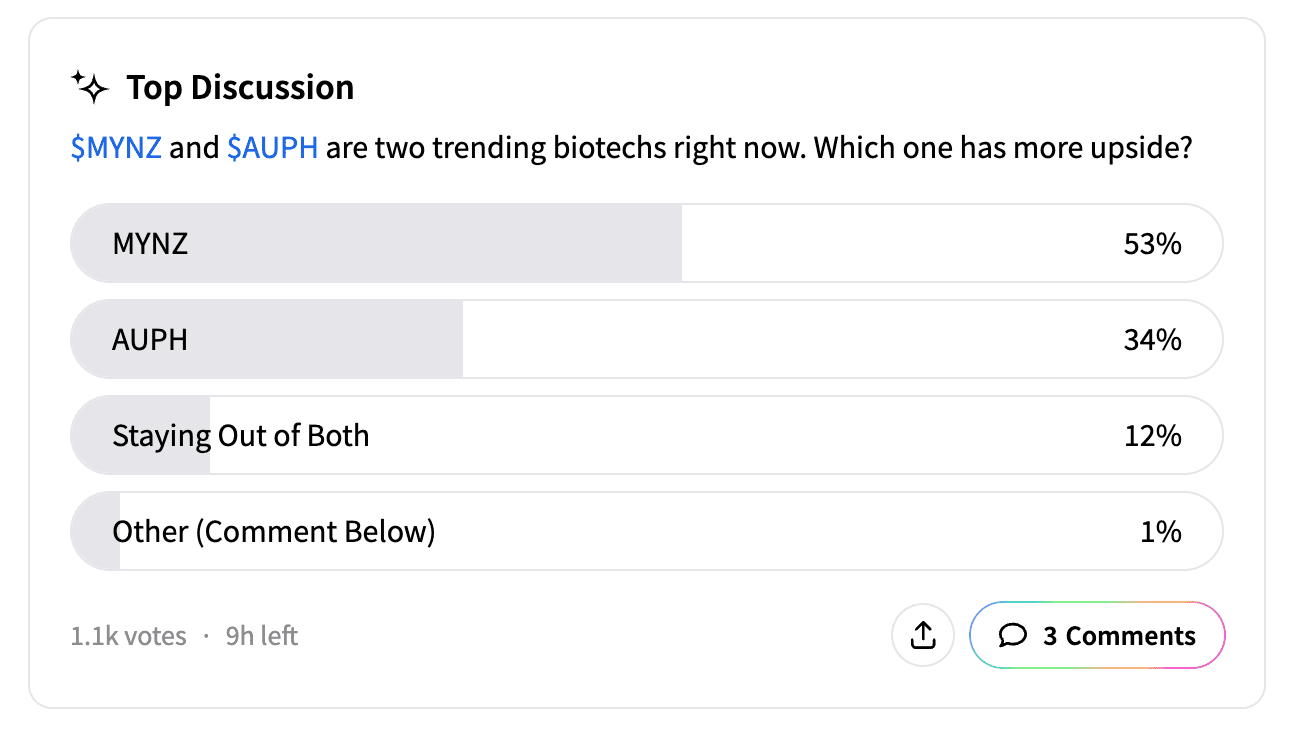

A recent Stocktwits poll of over 1,100 respondents found that 53% believe Mainz offers more upside, compared to 34% favoring Aurinia.

Maxim Group recently initiated coverage on Mainz with a ‘Buy’ rating and a $14 price target, highlighting its role in the $4 billion colorectal cancer screening market.

The firm is optimistic about Mainz’s next-generation test, which uses mRNA biomarkers to improve the detection of pre-cancerous adenomas and potentially enhance colorectal cancer prevention.

Mainz is conducting a clinical study on this test, with data expected in the second half of 2025, and plans to finalize protocols for a pivotal U.S. study in 2026.

In October, Mainz reported fiscal first-half loss per share had narrowed to $0.48 from $1 a year earlier, with revenue rising to $520,773 from $499,049.

The company’s cash and cash equivalents stood at $977,764.

Retail traders on Stocktwits have pointed to increasing institutional investment in Mainz, with funds such as Artisan Mid Cap Fund reportedly raising their stakes.

Some traders speculate that Mainz could see significant catalysts, including an upcoming product launch, a potential partnership, accelerated clinical progress, or an FDA resubmission with fast-track approval.

Aurinia, in contrast, has gained attention for its development of AUR200, a therapy targeting BAFF (B-cell Activating Factor) and APRIL (A Proliferation-Inducing Ligand). The company believes this could become a best-in-class treatment for autoimmune diseases.

It has already commercialized Lupkynis, the first FDA-approved oral therapy for adult patients with active lupus nephritis.

In its latest financial report, Aurinia posted fourth-quarter earnings of $0.01 per diluted share, a sharp turnaround from a $0.19 loss a year earlier and better than analysts’ projected $0.02 per-share loss.

Revenue for the quarter rose to $59.9 million from $45.1 million a year earlier but fell slightly below Wall Street estimates of $60.1 million.

For 2025, Aurinia forecasts revenue between $250 million and $260 million, trailing the $274.4 million expected by analysts.

Last year, Aurinia said it would strengthen its financial position by cutting nearly half its staff to save over $40 million annually.

The company also made leadership changes, including CEO Peter Greenleaf’s conditional resignation as a director.

As of Dec. 31, 2024, Aurinia held cash, cash equivalents, and investments totaling $358.5 million, up slightly from $350.7 million a year earlier.

According to Koyfin data, short interest in Aurinia stood at 7%, compared to 5.1% for Mainz.

Over the past year, Aurinia shares have gained more than 44%, though they are down over 9% year-to-date.

Mainz, meanwhile, has fallen more than 86% in the past 12 months but has rebounded over 25% since the start of this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)