Advertisement|Remove ads.

Jim Cramer Says 3 Nike Insider Buys Signal A Big Year Ahead — Calls China A ‘Win Now’ Market

- He pointed to recent open-market purchases by senior board members and the chief executive.

- The comments followed Nike’s latest earnings update and ongoing turnaround efforts.

- China was highlighted as a key region to watch in the company’s near-term strategy.

Nike, Inc. (NKE) drew fresh attention on Wednesday after Jim Cramer highlighted a rare cluster of insider stock purchases, arguing the buying activity points to growing confidence in the year ahead.

Insider Buying In Focus

In a post on X, Cramer said investors should not overlook recent open-market purchases by three Nike insiders, noting that such alignment is uncommon. He pointed to buying by Tim Cook, Nike’s lead independent director, Elliott Hill, and Bob Swan, who currently serves on Nike’s board and chairs its audit and finance committee.

Cramer said Swan’s purchase stood out given his background in finance, adding that seeing three insiders step in around the same period is unusual. He said such activity typically reflects optimism about the coming year.

Details Of The Purchases

Regulatory filings show Cook bought 50,000 shares of Nike Class B stock on Dec. 22 at an average price of $58.97, an investment of about $2.95 million, lifting his direct ownership to more than 105,000 shares.

Swan also purchased 8,691 shares at about $57.54, investing roughly $500,000 on the same day. On Tuesday, Hill added to the activity by buying 16,388 shares at an average price of about $61.10, worth close to $1 million, bringing his direct stake to 241,587 shares.

Nike Sees Early Wholesale Recovery

The insider buying followed Nike’s latest quarterly results, which beat Wall Street expectations but included a cautious outlook for the holiday quarter. Hill has said the company is in the “middle innings” of a multi-year turnaround after a period marked by leadership changes, excess inventory, and a shift back toward wholesale partnerships.

Nike has said wholesale has returned to growth globally, with improving order books for spring and summer. Inventory levels are now described as healthy across major regions, including North America and Europe, Middle East, and Africa (EMEA).

China And 2026 Outlook

China remains a pressure point for Nike, with recent quarters showing double-digit declines in sales and footwear demand amid tougher competition and tariffs.

Even so, Cramer said China would be a “win now” opportunity for what he described as a strong and innovative team, tying that view to the recent insider confidence signals.

How Did Stocktwits Users React?

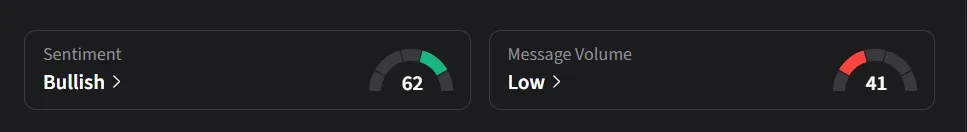

On Stocktwits, retail sentiment for Nike was ‘bullish’ amid ‘low’ message volume.

One user said the recent insider purchases added to the view that 2026 could be a key year for the company.

Another stock said the stock was “still undervalued”

Nike’s stock has declined 14% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)