Advertisement|Remove ads.

Marriott Stock Gets Price Target Hikes On Q4 Earnings Beat: Retail’s Bullish

Shares of Marriott International, Inc. ($MAR) were in the spotlight on Wednesday as the company received analyst price target raises following its strong fourth-quarter earnings, lifting retail sentiment.

Truist analyst C. Patrick Scholes raised the firm's price target to $308 from $277 with a ‘Hold’ rating, Fly.com reported. According to the analyst, Marriott’s core growth algorithm remains intact for 2025, but the post-earnings stock underperformance was mainly due to the cash return to shareholders guidance slowing down 10% year-over-year, added the report.

Susquehanna also raised the firm's price target to $285 from $255 with a ‘Neutral’ rating on the shares, Fly.com reported. According to Susquehanna , its formal 2025 RevPar guidance is below the previously projected guidance, noting stocks with persistent "structural gap" in supply and demand over the mid-term, added the report. Marriott projected 2025 RevPAR growth between 2% to 4% and Q1 2025 at 3% and 4%.

Marriott’s Q4 earnings per share came in at $2.45, beating consensus estimates of $2.39, while revenues stood at $6.43 billion, surpassing estimates of $6.4 billion, according to Stocktwits data.

"Marriott achieved excellent results in 2024, as we delivered best-in-class experiences that helped drive strong demand for our industry-leading portfolio of brands,” said Anthony Capuano, President and CEO of Marriott. “Full year global RevPAR rose 4.3% and, with record gross room additions of over 123,000, net rooms grew 6.8% to over 1.7 million rooms worldwide at year-end.”

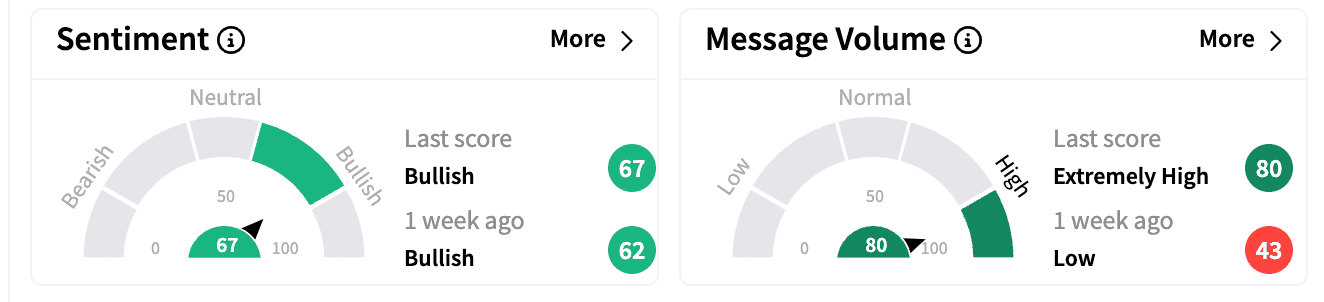

Sentiment on Stocktwits inched up in the ‘bullish’ zone from last week. Message volumes rose to ‘extremely high’ zone from ‘low.’

Marriott’s portfolio has over 9,300 properties across more than 30 brands in 144 countries and territories.

Marriott’ stock is up 4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/zenatech_png_21d6cbd6b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitccoin_39176cc376.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202932273_jpg_80ddd802d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)