Advertisement|Remove ads.

Short-Term Trade Idea: Max Healthcare Forms Bullish Reversal, Analyst Recommends Buying On Dips

Max Healthcare shares surged over 6% on Monday after the Central Government Health Services (CGHS) announced a revision of rates for nearly 2,000 medical procedures under the scheme. The new rates will take effect on October 13, 2025.

SEBI-registered analyst Deepak Pal noted this move boosts realization outlook for hospital chains handling CGHS cases, such as Max Healthcare.

Max Healthcare formed a wide-range bullish reversal candle on Monday after opening at ₹1,107.90, making an intraday low of ₹1,101.80 and a high of ₹1,148.10 before closing at ₹1,143.20, which signals strong intraday buying and short-covering. Pal said that the stock was now holding above the 14-day Exponential Moving Average (EMA) and the ₹1,135 horizontal support, with the RSI rebounding from below 50 toward the mid-50s and the daily MACD histogram flattening (still negative), suggesting a short-term mean reversion attempt rather than a confirmed trend reversal.

He identified support at ₹1,135 (14-day EMA) and ₹1,120 (stopwatch support), with immediate resistance at ₹1,190–₹1,200 and a higher resistance cluster near the 50 DMA around ₹1,240–1,260.

What Should Investors Do Now?

For a short-term trade (speculative), Pal suggested buying on dips at ₹1,135–1,140 with a stop loss of ₹1,120 and target prices of ₹1,190 (first) and ₹1,200 (stretch). Scale out 50% at the first target.

For an intraday setup, he advised traders to go long above the intraday high (₹1,148) on momentum with a tight trailing stop below the 14-day EMA.

For positional traders and investors, Pal advised a staggered accumulation (SIP style) or waiting for consolidation above ₹1,200 to reduce valuation risk.

Technical Outlook

In the short term, Pal is constructive on Max Health if ₹1,135 holds, and expects the stock to test ₹1,190–₹1,200 in a follow-through scenario. In the medium-term scenario, he remains neutral to cautious as the stock traded below longer moving averages, and needed a higher high and higher low confirmation.

Over the long term, he noted Max’s positive business case, but feels that technical confirmation is required. He advised traders to watch for a monthly close relative to the 50 and 100-month smoothing for a structural turn.

Triggers To Watch

Monitor the following quarterly updates and management commentary on occupancy, ARPOB, and guidance. Pal added that any upside surprise can trigger strong moves, but a miss may cause a sharp re-rating because of current high multiples. Additionally, policy updates on insurance reimbursements, NABH/NABL accreditations, and major tie-ups with insurers or govt schemes, which can affect volumes and collections, would be other catalysts to watch.

What Is The Retail Mood?

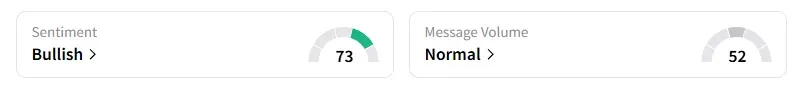

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a week on this counter.

Max Healthcare shares are flat year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)