Advertisement|Remove ads.

Mazagon Dock Charts A Technical Pause Ahead Of Q1 Results: SEBI RA Rohit Mehta Flags ₹2,850 As Crucial Level To Watch

Mazagon Dock shares have retraced 23% from their all-time highs. The stock traded nearly 1% lower on Monday ahead of its earnings later in the day.

Analysts expect a strong show in June quarter earnings (Q1 FY26) from the state-owned PSU, driven by the strong momentum in the defense sector.

SEBI-registered analyst Rohit Mehta noted that Mazagon Dock formed a rounded bottom pattern and gave a strong breakout in May 2025, reaching an all-time high. Currently, it is retracing from the top, testing a support. He believes that price action near ₹2,850 will be crucial to watch for further direction.

Mehta identified resistance at ₹3,775.25 (its all-time high), with supports between ₹2,856.70 – ₹2,765.55, followed by a lower support at ₹1,966.40 – ₹1,922.90.

He also highlighted that the company is virtually debt free, which gives it room for financial flexibility. Additionally, the company has delivered impressive profit growth of 38.3% CAGR over the last 5 years.

Mazagaon has maintained a strong return-on-equity (RoE) of 32.4% over the past 3 years, and a healthy dividend payout ratio of 26.3%. And in other positives, the company has cut down on its debtor days to 34.1 days from 50.7, indicating betterm receivables management.

On the flip side, Mehta said that the stock is currently trading at a premium valuation of 14.7 times its book value.

On the financial front, the company holds contingent liabilities worth ₹37,139 crore, which could pose future risk. And other income accounts for ₹1,121 crore, which may not be sustainable operationally.

In March quarter, the defense company reported a 2.26% rise in sales year-on-year (YoY), while operating profit fell 82.82%. Profit before tax reduced by 56.42% (YoY).

In terms of its shareholding, promoter holding has decreased from 84.83% to 81.22% in the last three months (March to June). Foreign Institutional Investors (FIIs) have raised their stake from 2.26% to 2.57%, while Domestic Institutional Investors (DIIs) holdings increased from 1.69% to 5.21% during the same period.

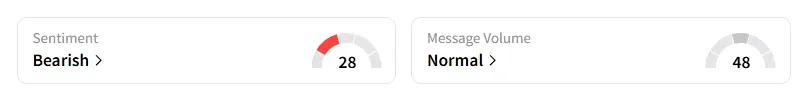

Data on Stocktwits shows that retail sentiment is ‘bearish’ ahead of the earnings.

Mazagon Dock shares have risen 29% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)