Advertisement|Remove ads.

Medtronic Logs Worst Day In Nearly 5 Years On Q3 Revenue Miss, But Retail Goes Bargain Hunting

Medtronic Plc. shares slumped nearly 7.3% on Tuesday — their worst single-day decline since March 2020 — after the company's fiscal third-quarter (Q3) revenue came in lighter than expected.

The medical device giant reported Q3 earnings per share (EPS) of $1.39, slightly beating estimates of $1.36, but revenue of $8.29 billion fell short of the $8.33 billion consensus.

The company’s medical-surgical portfolio was a key drag on results, as its revenue declined 0.4% year-on-year (YoY) to $2.072 billion. Medtronic said the segment struggled with ongoing stapling market pressures and temporary shifts in U.S. distributor buying patterns.

CEO Geoff Martha addressed the distributor issue on the earnings call, saying it had a "couple of hundred basis point impact" on surgical performance but added it would be resolved by the start of fiscal 2026. He also acknowledged ongoing competition in the stapling business.

Still, he pointed to substantial market share gains in its LigaSure vessel-sealing technology and continued double-digit growth in emerging markets as positive offsets.

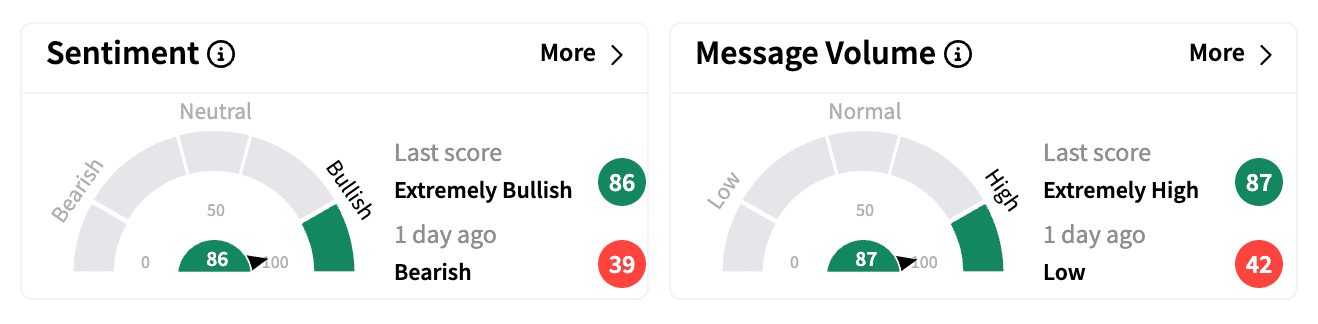

While the broader market sold off Medtronic, retail sentiment on Stocktwits surged to 'extremely bullish,' suggesting traders saw the dip as a buying opportunity.

One user, who believes it was "a good earnings report," expects the stock to rebound over $90 very soon, thanks to the "great guidance."

Another said they bought more of the stock, adding that "medtech companies like this will always go up long term."

Medtronic backed its full-year EPS forecast of $5.44–$5.50, with the midpoint above consensus of $5.45.

The company also reiterated expectations for FY25 organic revenue growth of 4.75%–5%, excluding currency impacts.

For the fourth quarter (Q4), Medtronic expects mid-single-digit revenue growth and high-single-digit realized EPS growth.

Despite Tuesday’s selloff, Medtronic shares remain up over 7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)