Advertisement|Remove ads.

Meta Q2 Earnings On Deck: Can Zuckerberg Justify Massive AI Bet To Wall Street?

Meta Platform’s (META) artificial intelligence (AI) initiatives take center stage as the social-media giant prepares to release its quarterly results after the market closes on Wednesday.

CEO Mark Zuckerberg has been rapid with his AI moves, setting up a Superintelligence group to pursue artificial general intelligence (AGI) and reorganizing the company’s AI business around the group. He has also invested in or acquired AI startups and assembled a talent pool by offering substantial compensation packages.

OpenAI has been on the receiving end as Meta poached several revered AI researchers from the Sam Altman-led company.

Meta stock hit a record high (intraday) of $747.90 on June 30, although it has since retreated from the level.

The stock closed Tuesday’s session down 2.46% at $700.

According to the Fiscal.ai-compiled consensus, Meta is expected to report earnings per share (EPS) of $5.86 and revenue of $44.84 billion. The guidance issued in late April envisaged revenue in the range of $42.5 billion to $45.5 billion, factoring in a one-percentage-point benefit from the exchange rate.

At that time, the company raised its 2025 capital expenditures (capex) guidance to $64 billion-$72 billion from $60 billion-$65 billion, citing increased data center investments to further its AI efforts and higher infrastructure hardware costs.

Meta investors may also keep an eye on key operational metrics such as the family's daily active people (DAP), ad impressions, and the average price per ad.

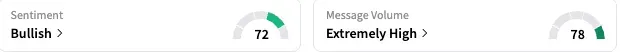

On Stocktwits, retail sentiment toward Meta stock was ‘bullish’ (72/100) by early Wednesday, with the degree of optimism improving from the previous day. The message volume increased from ‘normal’ to ‘high.’

A retail watcher sees the stock ripping after the earnings, following its recent pullback.

Another user saw a huge short covering coming up, expecting a 10%-15% upswing from current levels.

The short interest in the stock is 1.26%, up from less than 1% in March, although it has moderated from a mid-June high of 1.40%, according to Koyfin data.

Meta has gained approximately 20% year-to-date, earning it the distinction as the second-best-performing S&P 500 stock.

The average 12-month price target for the stock, compiled by Koyfin, is $756.13, implying over 8% upside potential from the last close. In Tuesday's early premarket session, the stock climbed about a percent to $706.60.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229385023_jpg_648b095662.webp)