Advertisement|Remove ads.

Meta Stock Gets New Street-High Price Target, But 16-Day Rally Hits A Speed Bump — Retail Turns Cautious

Meta Platforms, Inc.’s (META) stock fell on Tuesday afternoon despite receiving the highest price target on Wall Street yet while retail sentiment turned even more bearish.

Shares of the social media giant rose 66% in 2024 and have tacked on another 22.5% since then. They reached a record intraday high of $725.01 on Friday.

Despite the negative sentiment generated by reports of further job cuts, the stock closed at another record on Monday, extending its winning streak to 16 sessions, although it failed to break above the intraday highs

On Tuesday, Tigress Financial analyst Ivan Feinseth reiterated a ‘Strong Buy’ rating on Meta stock and increased the price target to $935 from $645.

The new price target suggests there exists an upside potential of 30% from current levels.

The analyst’s optimism stemmed from his view that Meta’s tremendous artificial intelligence (AI) opportunities focus on personalized AI-driven functionality across its platform of apps.

He expects this to drive increased user engagement, better content and a more effective advertising experience.

Feinseth is positive about Meta’s massive investment in AI. According to its fourth-quarter earnings release, the Mark Zuckerberg-led company expects capital expenditures of $60 billion to $65 billion in 2025, a marked increase from the $39.23 billion spent in the previous year.

He sees these investments to increase engagement and revenue growth.

The analyst noted that Meta plans to extend its Llama generative AI model to empower an increasing number of edge devices such as smart glasses, smartwatches, and camera-equipped earbuds.

He also highlighted Meta’s strong balance sheet and cash flow, which will help fund its aggressive growth initiatives and strategic acquisitions.

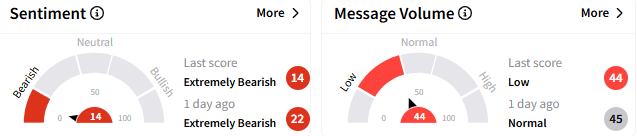

On Stocktwits, retail sentiment toward Meta stock remained ‘extremely bearish’ (14/100), the lowest score in about 11 months amid ‘very low’ message volume.

A watcher shared a technical chart and said the stock has fallen below an uptrending support line.

Another user said a sub-$700 price could be in the offing.

Meta stock was down 0.17% at $716.16 by mid-day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)