Advertisement|Remove ads.

Minda Corp: Smart Cockpit Deal With Qualcomm Could Be Inflection Point: SEBI RA Varunkumar Patel

Minda Corporation made a major leap into the automotive technology space by partnering with Qualcomm Technologies to develop smart cockpit solutions for the Indian market.

According to SEBI-registered analyst Varunkumar Patel, this move could mark an inflection point for Minda as it strengthens their positioning in premium passenger vehicles and electric vehicles (EVs).

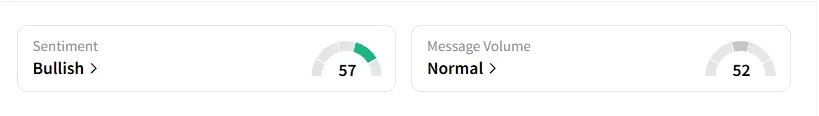

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on Minda Corporation for a few weeks.

Minda-Qualcomm Deal

Under this joint venture, Minda Corporation will develop next-generation cockpit domain controllers powered by Qualcomm’s Snapdragon Digital Chassis. This new technology will boost the vehicle dashboards with AI-powered interfaces, multi-display integration, and run on a combined Android + QNX architecture with seamless cloud connectivity. Patel said this would redefine the software-defined vehicle (SDV) ecosystem.

India’s automotive cockpit electronics market is projected to grow at a CAGR of 16–18%, reaching approximately ₹9,000–₹10,000 crore in FY25, and ₹19,000–₹21,000 crore by FY30. This covers infotainment, instrument clusters, heads-up displays (HUDs), and connectivity solutions, all of which Minda is now targeting with this JV.

Potential Impact For Minda

Patel notes that Minda currently holds a strong presence in mechatronics and plastic interiors, and this deal with Qualcomm adds a high-margin vertical with long-term potential.

To begin with, this integration with Snapdragon gives it a tech edge in the premium four-wheeler segment. And potentially unlock new businesses from global and electric vehicle (EV) OEMs.

Entry into the smart cockpit business is likely to boost Minda’s EBITDA margins by 70–100 basis points, according to him.

Additionally, with Indian OEMs shifting towards smart dashboards and digital cabins, Minda is now well-positioned to ‘future-proof’ its business against industry shifts towards EVs, Advanced Driver-Assistance Systems (ADAS), and digital mobility ecosystems

However, Patel cautioned that there are risks in the execution of such complex tech architecture, along with the dependency on Qualcomm’s ecosystem. Besides, it would take time before Minda sees any revenue materialize from this deal.

While the immediate earnings impact is limited, this deal with Qualcomm sets Minda for longer-term growth that could create immense value in the next three to five years, he concluded.

Minda Corp shares have risen 5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)