Advertisement|Remove ads.

Mining Giant Barrick’s CEO Says Mali Junta Doesn’t Want ‘Badly Run Legal Fight,’ Retail’s Bearish

Barrick Gold (GOLD) stock drew retail attention after it topped first-quarter profit estimates and said it would continue negotiations with Mali to restart a shuttered gold mine.

According to FinChat data, the company reported adjusted earnings of $0.35 per share for the quarter ended March 31, exceeding Wall Street’s expectations of $0.30 per share.

Its net income rose to $474 million, or $0.27 per share, for the first quarter, compared with $295 million, or $0.17 per share, a year earlier.

The company’s realized gold prices surged to $2,898 per ounce for the reported quarter, compared with $2,075 per ounce in the year-ago quarter.

Spot gold prices have surged this year after a 27% rise in 2024 on safe haven demand as tariff uncertainty has raised the odds of a recession.

Its copper production rose to 44,000 tonnes.

However, the company’s earnings declined sequentially as its gold production fell to 758,000 ounces, compared with 940,000 ounces a year earlier, primarily due to the shutdown of the Loulo-Gounkoto project in Mali.

The miner has been involved in a dispute with the Mali Junta over royalty payments and taxes. Barrick had to shut down the mine after Mali arrested four Barrick executives and seized three tonnes of gold.

“We continue our engagement with the transitional government and are working hard to overcome these challenges and achieve a long-term solution that puts an end to the current impasse,” CEO Mark Bristow said.

He told Bloomberg that Mali officials have repeatedly told Barrick they don’t intend to expropriate the mine.

The veteran CEO also said that he spoke with a member of the Junta and they agreed that “it's always better to have a negotiated settlement than a badly run legal fight.”

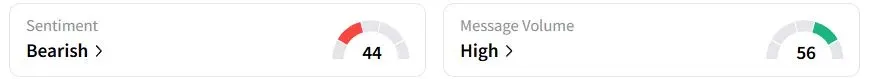

Retail sentiment on Stocktwits was in the ‘bearish’ (44/100) territory, while retail chatter was 'high.'

One retail trader said solving the Mali dispute alone could boost share prices by $4.

Barrick stock has gained 23.1% year to date (YTD).

Also See: Sezzle Stock Soars After Boosting 2025 Earnings Forecast, Retail Anticipates Even Bigger Jump

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)